+1 on the euro stable :). You could argue that btc on Tezos is much more environmentally friendly as once it is inside, the transactions happen on Tezos not Bitcoin anymore…

might not have to wait too long…

I tend to agree but I don’t see the point of waiting. This is a good thing now, it can become an even better thing later. This can literally be updated just 10 weeks after if and when better suited assets are available.

Can we not burn the trading fee and instead reward it back to bakers? To not reduce the incentives of running a baking node, that’s all I ask. Reconsider a new proposal with a redistribution of the trading fee back to bakers instead of burned.

Thanks in advance.

We should implement liquidity baking rather sooner than later. tzBTC is the most logical choice in my opinion. Of course, we can keep arguing about other coins and when the liquidity baking needs to stop. But, remember there is a possibility to add other coins later and there are multiple options to stop the liquidity baking. I believe the LB will only last for a certain period but it’s still a good thing. Governance will decide its future path. And lets be honest, the liquidity of FA1.2 and FA2 is not good at the moment. This is a good chance for Tezos to get more adoption in crypto in general. A big plus is more people will be trading on chain with Tezos and a small positive side effect will be a higher chance for tzBTC to get listed on centralized exchanges. Also, institutions like Taurus, mtPelerin and Bitcoin Suisse will have more reason to develop on and with Tezos.

In my opinion, despite the ongoing discussion and concerns, we should inject Granada. Nothing is set in stone and everything can be changed later. This proposal offers a great chance to test how good liquidity baking will work and if the “incentivizing” has its suggested impact.

In future proposals more assets can be added or removed.

Why would anyone LP if they earned nothing for it?

IMO everyone should ask themself an important question. WHAT IS THE BEST FOR THE ECOSYSTEM AND WHICH PROPOSAL WILL MOSTLY BENEFIT TEZOS AS A WHOLE?

The ecosystem has bigger issues than which asset from which entity is better.

Tezos must be first established besides BTC and ETH. After that, there is enough time for such topics as which entity will provide assets. In the end, if Tezos thrives everyone in the ecosystem will benefit from users to bakers and company.

Nobody is saying that LP’s won’t earn anything. TEZ is printed for them, but then we charge to TRADERS a fee to counter the inflationary minting as stated in the proposal, then we can either burn that or redistribute that trading fee back to bakers. The way I see things, is that bakers are funding that subsidy, and the trading fee should not be burned, It should be given back to bakers to not reduce the incentives to run a baking node.

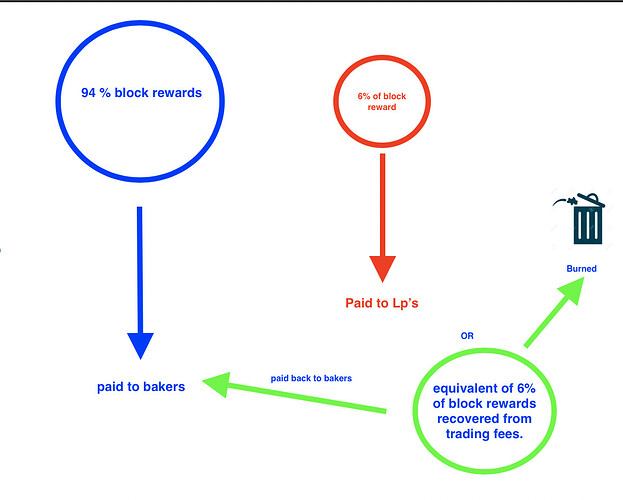

Before liquidity baking we had 100% of the block rewards going to bakers, after liquidity baking, bakers will only be paid 94% of the block reward, and that 6% will be paid to LP’s as reward, to recover what is being paid to LP’s, a trading fee will be charged to traders, the TEZ recovered is what i propose it should be paid back to bakers, so bakers recover the 100% of the whole pie of the block rewards, instead of burning that 6%.

Well, Tezos should get USDC or/and USDT to its platform. It should be a priority to get the stable coin standard to XTZ. But I would not wait for implementing LB because other pairs can be added later and the current proposal benefits Tezos from the start.

No one wants to trade with random single blockchain wrapped assets. They’re completely irrelevant

The focus should be on partnering with wBTC, USDC, USDT for Liquidity Baking. You know like a name brand that people actually care about. People want to trade assets they know not some random wrapped asset they’ve never heard of before with zero interoperability

it’s been 3 years and no sign of usdt/usdc/wbtc on tezos, do you really wanna wait more?

Wrapped is a decent option but it has to be better tested

Where does the equivalent of 6% of block rewards recovered from trading fees should go? To bakers or to the trash can? We had 100% of the whole pie of the block rewards going to bakers before all this thing of liquidity baking came up.

I’m a baker and I can’t join the Tezos Slack because I don’t have an email address at tezos.com tezoskorea.com tezosindia.foundation or tqtezos.com

There’s a message saying to Contact the workspace administrator at tezos-dev for an invitation.

But I have no idea who I need to contact.

I agree with Arthur’s stance. I rather implement it now and add tokens later like usdc when it comes to Tezos. It’s better than waiting for months

That’s fair, I will vote in favor.

This is not accurate. The liquidity baking subsidy is not subtracted from baking and endorsing rewards. It is additional inflation so deflating the currency by burning tez is entirely appropriate.

It is not subtracted in absolute numbers, as we still are going to be paid the 80 TEZ of the block, but it is subtracted in % terms. Printing an additional 5 TEZ will indisputably reduce the % of the pie.

My point is that doesn’t specifically disadvantage bakers. It disadvantages tez holders. If the amount currently burned was instead transferred to bakers then that would result in bakers being paid more than they are in Florence.

Nope, they would be paid around 100% of the block rewards, same as before, not “more”. The key is % not absolute numbers.

Overall I like the proposal, I like that Liquidity providers are paid with the most liquid currency of the Tezos ecosystem, XTZ, I have never seen in Ethereum a project paying liquidity providers in ETH, always in illiquid tokens. For the first time, we will be paying LP’s with the native most liquid currency of the network.

I just don’t like what I just mentioned, and I don’t like that is a risk, because the trading fee is not a guarantee that it will recover what was minted.