Last day report

Today, we’ll reflect on the entire week and delve into how various events and delegate parameters influenced stakes and rewards.

Bakers

Throughout the week, the two delegates pursued distinct strategies:

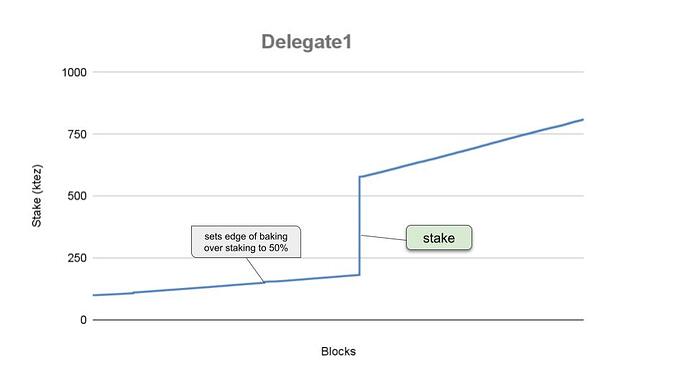

Delegate1adopted a conservative approach, initially staking a smaller amount of tez. It began with a staking over baking edge set at 100%, later adjusted to 50%, which was more enticing for stakers as depicted in the following chart.

- In contrast,

Delegate2staked a substantial amount of tez and maintained a staking over baking edge of 10% from the outset.

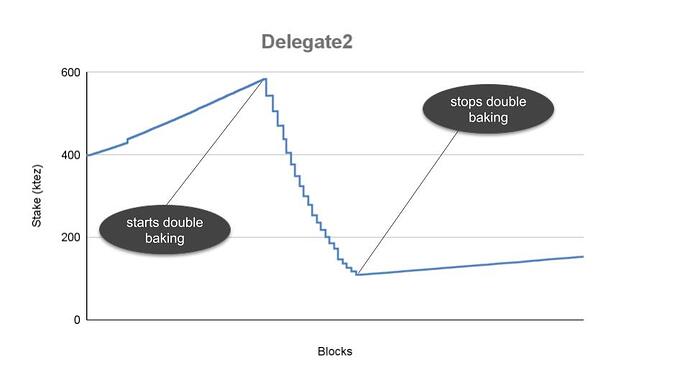

However, on Day 3,Delegate2encountered challenges with double baking, triggering a cascade of denunciations and slashing. While not directly tied to the staking user experience, this scenario provided insight into how the network handles misbehaving delegates. Notably, despiteDelegate2possessing a considerable stake, its exclusion from consensus had minimal impact on the network.

The following chart illustrates the progression ofDelegate2’s staked balance over the week:

We observeDelegate2’s stake growing with rewards before being impacted by slashing. The staircase pattern reflects the effect of the forbidding mechanism, which imposed a 1 to 2-cycle prohibition on double baking after each denunciation.

Stakers

Similarly, we can track the evolution of staker’s balances throughout the week.

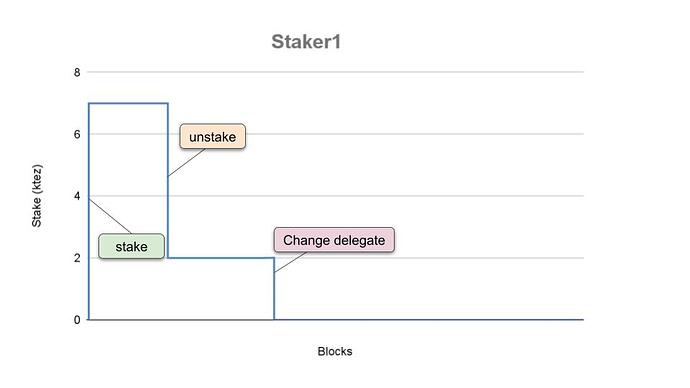

Staker1 pursued a straigthforward strategy. Initially, it staked a significant portion of its balance. However, due to Delegate1 maintaining a 100% edge, Staker1 did not receive any staking rewards. Subsequently, it unstaked part of its stake and changed its delegate. It’s important to note that changing delegates triggers an implicit unstake everything, and funds cannot be staked via the new delegate until all unstake requests are finalized. As a result, Staker1 did not restake and therefore did not benefit from the staking mechanism.

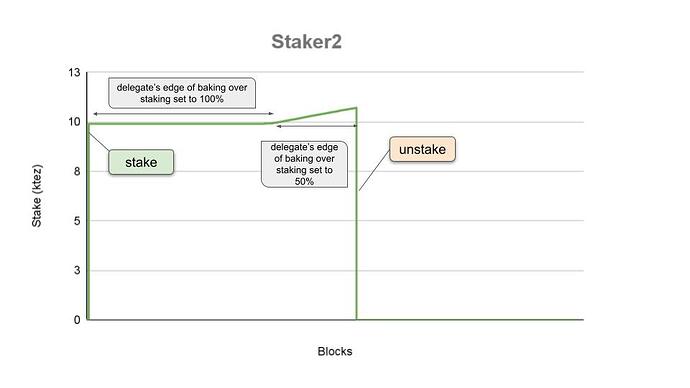

In contrast, Staker2 pursued a simpler strategy, staking its entire balance with Delegate1 and eventually unstaking everything:

Although Staker2’s behavior was straightforward, it’s worth noting how its chosen delegate’s settings influenced its rewards. With Delegate1 maintaining a 100% edge, Staker2 did not receive any staking rewards initially. However, after Delegate1 adjusted its baking over staking edge to 50% on Day 3, Staker2 began accruing staking rewards.

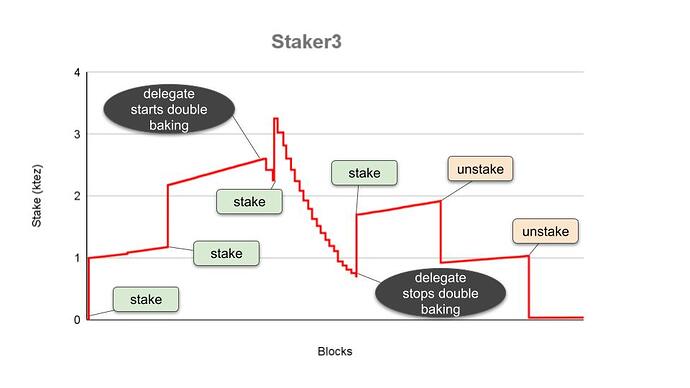

Staker3’s scenario was more intricate. Initially, it increased its staked balance through regular manual stake operations before choosing to unstake towards the end of the week. Since Staker3 delegated to Delegate2, it was affected by its chosen baker’s misbehavior and consequently was slashed proportionally.

Staker4 chose not to stake at all, thus never earning staking rewards from its delegate. However, it was also unaffected by its delegate’s misbehavior and subsequent slashing.

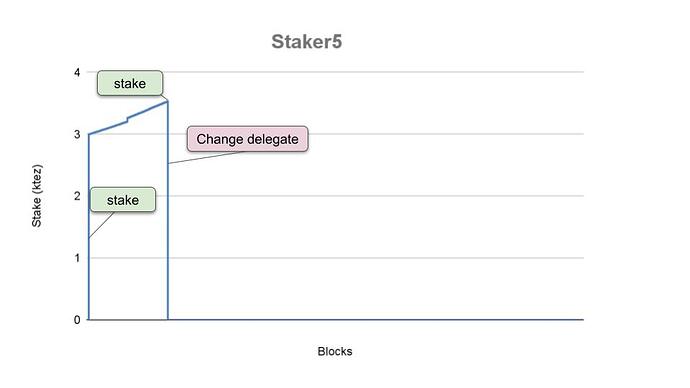

Staker5 initially delegated to Delegate2 and began receiving staking rewards immediately. However, it later changed its delegate, resulting in Staker5 unstaking all its stake as it did not restake.

Tracking Adaptive Issuance

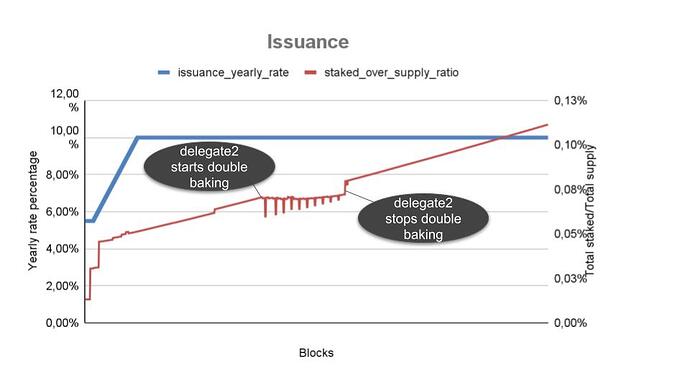

Additionally, examining the overall issuance during the week provides valuable insights. The following figure illustrates how both the issuance rate and stake ratio evolved over the week.

As expected, with the progressive min-max mechanism in place, the yearly rate followed the progressive max curve, increasing from 5.5% to almost 10%. The high issuance rate can be attributed to the low stake ratio observed on Weeklynet (below 1% of the total supply). Furthermore, this chart depicts the effect of the double baking scenario on the stake ratio, particularly highlighting the impact of the forbidding mechanism. This mechanism repeatedly forbade Delegate2 , rendering it inactive for one cycle, which decreased the total staked supply until its automatic reactivation.

Conclusions

Throughout the week, we explored various scenarios demonstrating how delegates and stakers manage their stakes. We showcased how these actions can be effectively observed, monitored, and managed with the support provided by the Octez suite – that is, by quering the RPC endpoints provided by Octez nodes and the staking commands implemented as a part of the Octez client’s CLI.

Our aim was to provide insight on the intricacies of the staking process, including how the parameters set up by bakers influence protocol-allocated rewards and staked balances.

We also illustrated how the protocol is equipped to address potential delegate’s missbehavior, and how it might impact their stakers – Again, the scenario presented is highly improbable on Mainnet.

As this reports marks the end of our initial exploration, we wait eagerly for your feedback. It will allow us to build further upon this experience, delving into the evolving features of the protocol, and developing additional scenarios to address bakers and users concerns.