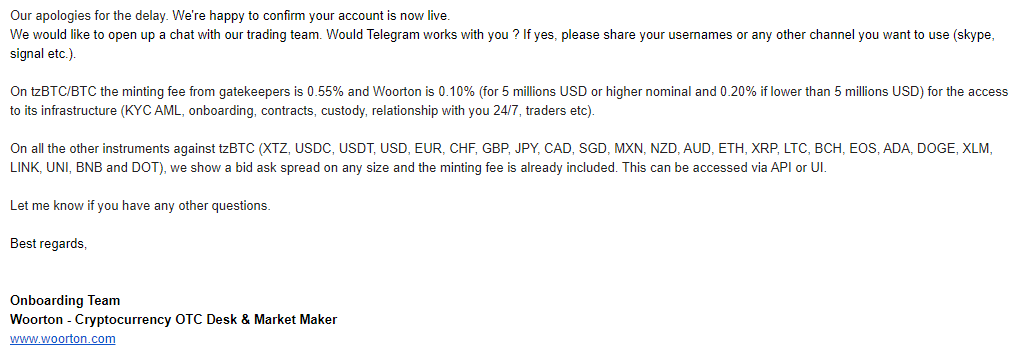

Some more update, after 2 months of waiting, I’m finnaly onboarded with Woorton , here is the conversion fee if someone interested here:

According to the discussion here Announcing Granada - #25 by murbard , I’m expected fee around 0.22%, but the reality is the fee is at least 0.65-0.75%, so that probably explains why atomex charges 1.x% conversion fee.

This is a lesson for every baker when consider future proposals which includes any third parties.