USDtz for LB in Ithaca — Why LB is great for Tezos DeFi! (and why it’s tzBTC alone that’s always been the problem)

We have injected Ithaca-Ipanema 2 as of January 28th 2022

How to vote for it:

tezos-client submit proposals for YOUR_ADDRESS PscPJfNBhckv3mS4f6bg3VhTw9fBbR8DUcdZeSKpfgiufsgCEoE

There are many passionate opinions about Liquidity Baking and about the intentions of anyone attempting to amend it. I implore the reader to read through this article in its entirety and to keep an open mind. USDtz improvements have been made since the last proposal, while Liquidity Baking has only suffered more under the failed use tzBTC. In this piece we hope to prove:

- Why LB never failed, only tzBTC did (other BTC wraps wouldn’t have)

- Why a USD stablecoin is better for LB than a BTC stablecoin

- Why for LB specifically, USDtz fits better than other USD stablecoins

- How a successful LB will grow the broader free-market Tezos DeFi ecosystem 100x in liquidity and volume

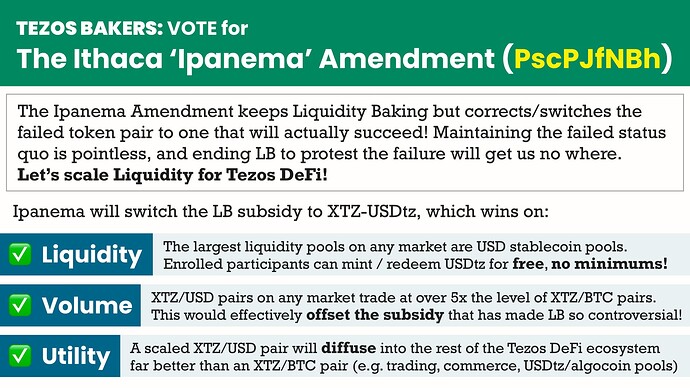

We, Kevin Mehrabi and Bilal El Alamy of StableTech propose that the subsidy for the failed XTZ-tzBTC pairing end, and instead the subsidy be used for an XTZ-USDtz contract. The purpose of this is to improve Liquidity Baking so that it advances the greater Tezos DeFi ecosystem by secondary and tertiary effects, which should be seen as its purpose, as well as to at the same time mitigate the subsidy.

The amendment that would change the token pair [was always intended to come from a community injection]((How to Change the Liquidity Baking Asset Pair | by Sophia Gold | The Aleph | Medium). tzBTC, while at the time of its implementation in Liquidity Baking had certain key merits, has revealed itself to be an utter failure — for very identifiable reasons. We are making this proposal based on the publicly given instructions to do so, as written in this article by one of the architects of Liquidity Baking.

If you would like to do a thorough read, you may want to start with the Agora thread from our previous proposal.

USDtez (USDtz) is the first FIAT-backed stablecoin on Tezos. It launched May 2020, almost as early as tzBTC. USDtz was developed by StableTech (Tezos Stable Technologies, Ltd) through its Tezos ecosystem partners including Wealthchain, Inc. and Cryptonomic, Inc. It is backed by Draper Goren Holm LLC. StableTech itself is a wholly-owned subsidiary of Tezos Stablecoin Foundation, a non-profit and non-shareholder foundation.

USDtz reserve and administrative contracts are audited monthly by Armanino LLP. Those audit/attestation reports are financed by the Tezos Foundation and are published on the USDtz website.

Foundations of Liquidity Baking

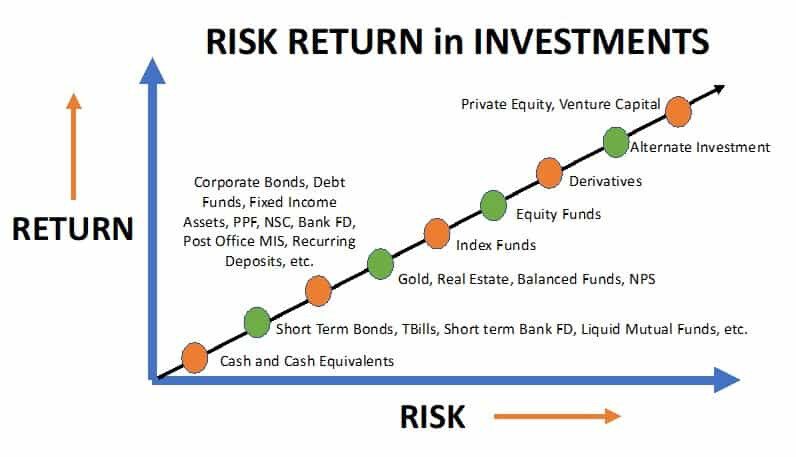

It’s important to understand the intended role of liquidity baking. It is not meant to compete with Tezos DeFi dapp-level platforms. It is not intended to be some alternative to a yield farm. It’s meant to be a stable low risk profile instrument, with stable low risk profile returns, for stable low risk profile investors. (That is, probably not the typical DeFi investor, however it will benefit the typical Tezos DeFi investor on a secondary and tertiary level many times over).

Risk-free Instruments

The term ‘risk-free’ is used to describe instruments that have a fixed future return — and thus offer a low-risk profile to investors. Risk-free instruments thus offer certainty to investors. In exchange for this certainty, risk-free instrument returns are expectedly low — lower than virtually every other investment opportunity.

The principal example of risk-free instruments are T-Bills (from the U.S. Treasury). Being backed by “the full faith and credit” of the U.S. government, investors feel very confident that their T-Bill will be honored to full maturity. T-Bills are one example of Treasury securities. Other risk-free instruments include T-Bonds, T-Notes, TIPS, and others. The U.S. government issues trillions of dollars in these assets annually (that’s right, trillions!). Many people ask why would anyone choose such a low-return, let alone at such high-amounts of money? The answer: certainty!

Since low-risk profile instruments offer the path of least resistance for investors that are not ‘heat-seeking’ investors (such as the die-hard crypto maximalist) but rather those building intentionally low-risk profile portfolios — these include pension funds, municipal treasuries (state, county, city), international treasuries, foundation endowments, and insurance companies. Even mid/high-risk investors such as hedge funds, private equity, and venture capital firms may keep a designated proportion of their investment portfolio in risk-free instruments to manage actuarial risk and/or keep underwriters happy. https://www.treasurydirect.gov/govt/reports/pd/mspd/2021/opds112021.pdf

A very important point about the aforementioned low-risk investors — it is these very institutions who end up either investing or underwriting mid/high-risk investment opportunities, or otherwise investing or underwriting those who do (or even several more tiers removed). Therefore, the risk-free instruments, despite offering a low return in exchange for certainty of outcome to their direct investors, effectively enable the extension and multiplication of capital to mid/high-risk investments by secondary or tertiary level. It is for this reason that we can start to reexamine the potential benefits of Liquidity Baking, and how it can help the Tezos DeFi ecosystem scale to billions and trillions of dollars in self-sustaining value.

Imagine if we could channel the same or similar risk-free sentiment to Tezos DeFi — that is, bringing in such a ‘path of least resistance’ to investing billions of dollars in a low-risk/low-return, yet nonetheless, stable predictable and confident — we can to build a cornerstone on which higher-risk/higher-return financial layers of the Tezos DeFi economy can be built.

Risk-free Instruments in DeFi

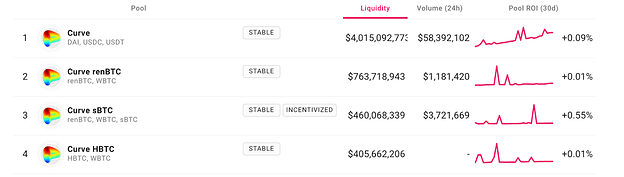

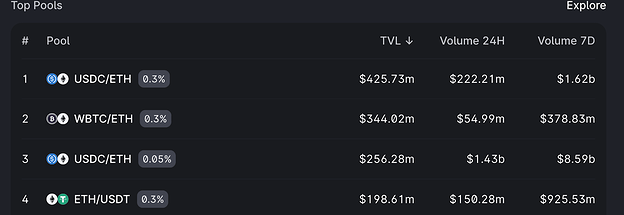

The ‘path of least resistance’ that risk-free instruments have an observable mainstay in DeFi as well. One merely needs to observe what are the largest liquidity pools in DeFi. The largest by far are either USD-stablecoin to USD-stablecoin pairs, or ETH to USD-stablecoin pairs, BTC-wrap to USD-wrap pairs, and ETH to BTC-wrap pairs.

The largest by far is Curve’s USDC-USDT-DAI pool (a tri-pool of USD-stablecoin instruments that is 2 parts FIAT-backed and 1 part algocoin) at over 4 billion dollars indicating ROI of 0.09% over the last 30 days.

The second largest pool is Curve’s WBTC to renBTC pool (2 wrapped BTC tokens), and the next 2 largest Curve pools are also pools composed entirely of BTC wraps.

Turning our attention to Uniswap, the largest pool there is USDC/ETH (1 part FIAT-backed USD-stablecoin, 1 part ETH). The second largest pool is WBTC/ETH. Not only that, but as ratio of volume-liquidity, the USDC/ETH pool far outperforms the ratio WBTC/ETH. This is reflective of the weight in which USD-stablecoins have in the DeFi trading economy relative to wrapped BTC.

Wouldn’t a USDC/ETH pair invite the possibility of the dreaded ‘Impermanent Loss’ more so than WBTC/ETH — a pair in which the asserts are presumably more correlated? Yes, however, correlation is a double-edged sword (i.e. what correlates upwards together also crashes together), and risk-averse investors are actually more mindful of that lack of certainty than they are about the potential opportunity loss of a unidirectional outcome. This reiterates the importance of ‘risk-free’ investments, as a function of the US denomination. (Once again, this is NOT for the typical high-yield seeking DeFi investor)

Liquidity Baking as a Risk-free Instrument

Liquidity Baking is a protocol-level Automated Market Maker contract (somewhat like Uniswap, Quipuswap, and many other commonly known DEX which are deployed on the DApp level) that was deployed with the Granada upgrade of Tezos in August 2021.

Unlike a traditional AMM, Liquidity Baking does not award liquidity providers with fee-based returns from the trading conducted with the contract. Rather, liquidity providers receive a nominal 2.5 tez/block subsidy proportional to their liquidity pool contribution. This fixed-rate per block subsidy offers liquidity providers with a stable and predictable return mechanism that is granted on a protocol-level, with the confidence of the blockchain protocol code as opposed to a “3rd party” developer creation. Akin to the confidence awarded by the T-Bill’s “full faith and credit” of the U.S. government, the assuredness an investor can ascribe to Liquidity Baking is that so long as the Tezos blockchain continues to produce blocks, 2.5 tez will be awarded at each block.

Traditional [fee-based] AMMs come with much higher risk as the returns for the investor on these AMMs are entirely variable and are a function of volume. Even an AMM that has historically attracted high volume (i.e. the liquidity pool is highly utilized by traders as an exchange conduit), offers no guarantee that they will continue to produce such high volume. With Liquidity Baking, volume does not matter to the investor. The AMM could perform very well with high utilization, or poorly with zero utilization, but nonetheless Liquidity Providers will be paid 2.5 tez per block, as a matter of fact and as sure as the Tezos blockchain continues to produce blocks.

Therefore, (and this will shock a lot of people) the subsidy is a good thing. Its benefit is not simply the encouragement of a scale-up of LB liquidity, but in its risk-free offering of certainty, in as much as treasury instruments (such as the T-bill) offer certainty. In fact, it should be able to neutralize itself with enough trading volume.

The Liquidity Baking Investor

There are two main types of investors in crypto: those who see their assets as an ultimate settlement in USD, and those who see it as a proportion of crypto (namely, Bitcoin).

The target market for Liquidity Baking’s liquidity providers are therefore not the ‘Degen” crowd we’re perhaps used to seeing participating in the high-risk/high-return world of crypto, but rather what is closer to the risk-free investor that we see in traditional finance, or in the largest liquidity pools in DeFi.

Making Liquidity Baking Succeed!

This section examines what is the optimal token pair for liquidity baking based on different matters of concern. It also examines the ecosystem benefits and what success means for Tezos DeFi.

Mitigating the Subsidy

It’s important to not mitigate the subsidy simply for mitigating the subsidy sake, but to use an instrument which makes Liquidity Baking succeed and for which it just so happens to be that it would produce enough volume and thus enough fees, and thus enough fees burned, to mitigate the subsidy. To mitigate the subsidy two improvements are needed: the instrument must be changed to one that is far more accessible so as to enable flow of much more liquidity into liquidity baking (increasing of the TVL), and the denomination must be changed to one that can enable much more volume activity per unit of XTZ invested.

Since the start of Liquidity Baking, a nominal .1% fee is taken for each trade within LB. This .1% fee is burned so to offset the subsidy in part or in full.

For the subsidy to be completely mitigated, the liquidity that the subsidy attracts must achieve a per block average of literally 1000x (one-thousand times) that subsidy as a measure of tez (XTZ). That is, the subsidy produces 2.5 tez per block (at 30 second block times, that is 7200 tez per day), and therefore 7,200,000 tez volume must be achieved daily in order to offset the subsidy in full.

Better Instrument (BTCtz vs tzBTC)

Aside from the question of whether or not BTC is an optimal denomination, the current instrument has failed to achieve its desired goals. XTZ-BTCtz is a much better option than the failed XTZ-tzBTC, for many reasons.

Bad - tzBTC: Since liquidity baking launched, tzBTC has been distributed by a single centralized liquidity provider — this single centralized liquidity provider is therefore the gateway for all tzBTC entering the Tezos market ecosystem market. This liquidity provider charges a purchase fee .65%, a redemption fee of .65%, and a per-ticket minimum of $500,000. This has been financially untenable for most liquidity providers, and has made it extremely challenging to bring liquidity into liquidity baking. This is why liquidity in LB has never exceeded $20,000,000 even though the goal was for it to be 100x larger than the largest liquidity pool on Tezos.

Better - BTCtz: Unlike tzBTC, BTCtz is minted by a network of minters throughout the Tezos ecosystem, with a special emphasis on Tezos bakers. It costs minters 0% to mint and redeem. The only costs paid are the costs of gas to transfer to underlying collateral during a redemption. Qualifying individuals and institutions (including and especially bakers) can enroll to be minters at mint.stabletez.com. A number of baking services have found becoming ‘minteries’ providing “minting as a service” to be a great supplemental revenue stream that leverages the trust built on their existing networks. This will enable the free flow of capital to Tezos markets by entrypoint liquidity providers, and thus bring about more liquidity to Liquidity Baking.

However, not any BTC stablecoin is the most optimal choice for LB.

- Filing XTZ-USD TVL is easier to bring in (because it hedges against crypto market)

- On traditional markets XTZ-USD produces over 5x the daily volume of XTZ-BTC

- XTZ-USD pair can provide a much better benefit to the Tezos DeFi community

• secondary effects (algocoins pairing, stable exchanges, convertibility, lending)

• money multiplier effect

(more on this in Ecosystem Benefits)

Better Denomination (USDtz vs BTCtz)

Besides having a better instrument — a token capable of bringing in large amounts of liquidity without the hindrances of predatory rates — we must also consider that BTC is not the optimal choice to pair with XTZ with regard to volume.

Best - USDtz : To achieve the needed volume to mitigate the subsidy, the XTZ-USD pair is a better pair than XTZ-BTC. One reason for this is that a less-correlated pair would achieve much better volume than a more-correlated pair. As an extreme example, with perfect 100% correlation there would be zero volatility of price, and therefore zero arbitrage opportunities, and thus volume would suffer. Another reason is that on scaled exchanges (to which we need only look as far as the past 3 years of XTZ trading on centralized exchanges. XTZ-USD pairs achieve over 5x the volume of XTZ-BTC pairs across all major centralized exchanges. The vast majority of XTZ trading in general is between XTZ and USD instruments (mostly USDT and almost entirely FIAT backed USD stablecoins).

Hence, between BTCtz and USDtz would be the better option — easier to get in more liquidity, it’s much more capable of producing volume high enough to mitigate the subsidy, and it has the capability of producing secondary and tertiary effects that would advance Tezos DeFi TVL and volume well beyond the levels of Liquidity Baking itself.

Ecosystem Benefits

Many have fairly asked what the point of any of this is; supposing LB with USDtz is so successful that it achieves 10x the liquidity of LB with USDtz, and enough volume to mitigate its own subsidy — why does it matter? Without a reasonable path to LB benefiting the rest of the Tezos DeFi ecosystem (the free-market independent ecosystem built by the community), it’s hard to find justification for it. We agree. This is another reason why a USD denomination paired with XTZ, will serve the Tezos DeFi ecosystem much better than a BTC denomination paired with XTZ.

Secondary Benefits

With much USDtz in hand from arbitrage trading of XTZ-USDtz, XTZ and dollar-backed USD capital will be free to park in different parts of the Tezos DeFi ecosystem

Algocoin benefits: An immediate secondary benefit to a swell of XTZ and USDtz in the Tezos DeFi ecosystem will be in enabling the rapid scale of Tezos algocoins. Algocoins are a critical part of a successful DeFi ecosystem. Algocoins enable users to leverage their existing assets to effectively borrow USD assets without having to sell those existing assets. Successful examples of Algocoins on other ecosystems are DAI on Ethereum, and UST on Terra. On Tezos, successful algocoins include Kolibri USD (kUSD), and Youves USD (uUSD).

Without a readily-available and scaled USD convertibility option however, it is very difficult to scale algocoins without destabilizing the peg, or otherwise astronomically increasing stability fees. Algocoin stability fees are raised as a means to encourage people to return more of the algocoin (burning it) so as to reduce the liquidation exposure of their collateralized debt position. It is performed when the price loses its peg and the algocoin is undervalued from its attempted peg to the dollar. This price destabilization often occurs at times of uncertainty in the price of the base asset.

LB with USDtz will enable liquidity so large between XTZ and its most used trading instrument USD, that other tokens in the Tezos DeFi ecosystem which depend on high convertibility value will be able to expand their own liquidity with a much closer back and yet with low-stability fees.

DEX benefits: With respect to convertibility, a mechanism is needed to enable liquidity pools for these USDtz to algocoin pairs, with low slippage and for high-volume trades.

This convertibility will be enabled by stable-swap exchanges, of which there are several coming to Tezos including Liquibrium, Convert.fi, and another from Madfish. These exchanges pair assets of like-value in pools that provide low-slippage high-volume trading. An example of a successful stable-swap exchange Curve.fi. To give an indication as to how large we can expect these pools to become, the largest pool on Curve.fi is actually the largest liquidity pool in existence by far: a multi-billion dollar tri-pool between USDT+USDC+DAI.

Money Market benefits: Lending systems (money markets) are the engine that scales any finance ecosystem. This has been the case since the start of modern banking that heralded the Dutch golden age. Lending systems give participants a place to park their funds and gains from other areas of finance and gain interest, instead of merely spending or converting it to another capital form that doesn’t benefit the ecosystem at hand. Lending systems give borrowers an ability to leverage capital they wouldn’t otherwise have to invest in the ecosystem — to invest in the prospect of future events being better than the present.

DeFi is no exception to this. Before there were money markets like Compound or Aave on Ethereum, TVL had been as small as Tezos DeFi TVL is now. After the first wave of scaling for Compound and Aave, DeFi TVL on Ethereum had grown to several hundred million dollars. Upon the addition of incentive programs for Compound and Aave, TVL had quickly grown to over $10 billion.

On Tezos, several DeFi protocols are coming including Yupana, Control Finance, and TezFin (Tezos Finance). LB with USDtz gives arbitrageurs a massive amount of XTZ and USDtz capital to park in these lending systems — enabling larger pools for borrowers to create debt positions and invest that capital into other areas of the Tezos DeFi ecosystem.

Tertiary Benefits

The aforementioned secondary effects/benefits of a successful (corrected) Liquidity Baker, lead to even more compounded tertiary effects/benefits. That is, the secondary benefits (which extend much more capital to the Tezos DeFi ecosystem’s components) lead to the growth of reinvested capital in DeFi (exchanges, yield farms) as well as commerce (e.g. NFT marketplaces). This is most commonly understood as the multiplier effect.

As explained, the growth of USDtz capital coming from this amendment would scale USDtz-algocoin pools — enabling those algocoins to scale to a much larger supply with low-stability fees. Those algocoins will likewise scale pools with other tokens at a much lower cost of capital (e.g. with uUSD-PlentyDAO, uUSD-CRUNCH, uUSD-SMAK, etc).

As those pools scale, they contribute to generating upward demand for those other DeFi tokens (assuming the circulating supply for those DeFi tokens aren’t flooding-out their utilization growth). As demand and staking of those DAO tokens increase, so too can the liquidity pools that those DeFi tokens have between their own token and other tokens (i.e. Plenty-to-[some token] pairs)

Likewise, by enabling more liquidity to enter money markets (lending systems) that are about to launch on Tezos, even more capital would be borrowable for other liquidity pools, yield farms, and other aspects of the Tezos DeFi ecosystem. Those liquidity benefits circle back to enrich other areas of the Tezos DeFi ecosystem. Onwards and upward it goes.

An XTZ-BTC pairing would likely not achieve this, and has not achieved this.

USDtz Upgrades Since Hangzhou

Since the Hangzhou Proposal Vote

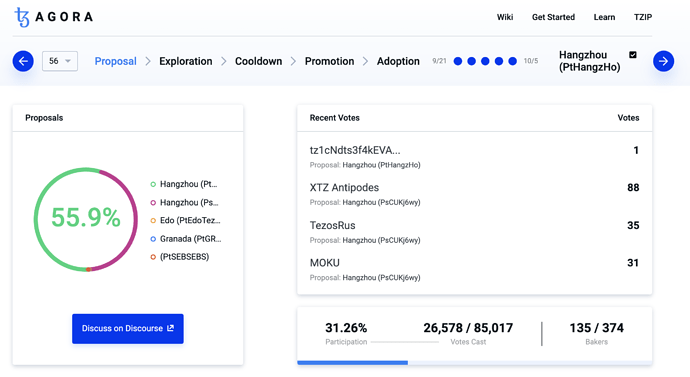

We made a similar proposal a few months ago during the Hangzhou vote, and despite entering it after most the voting period had already passed, it ended up being the closest vote in Tezos history and had more turnout than any Proposal phase vote since Babylon over 2 years prior. Over $1 billion of delegated tez (given fair market value of tez at the time) voted for our proposal. If you’d like to see the thread for that vote, which I strongly encourage, please see this link.)

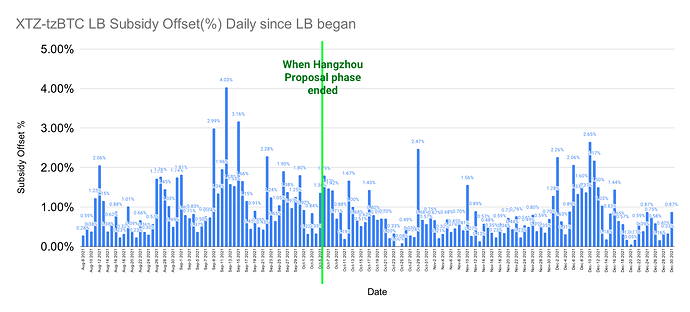

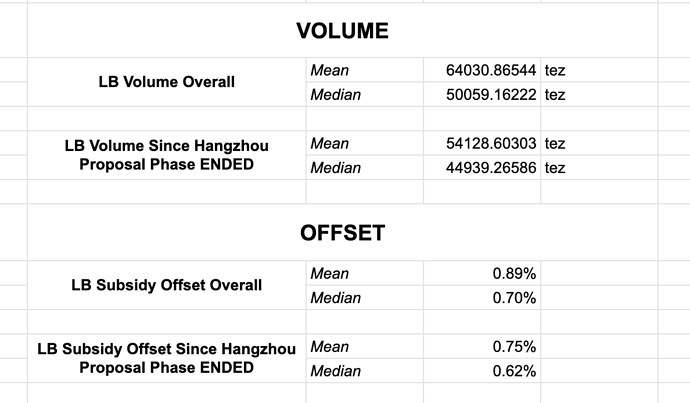

Some bakers said that maybe we should give tzBTC more of a chance, even though it wasn’t a matter of time, but a matter of centralization of tzBTC liquidity distribution to the general market, and restrictions placed on getting tzBTC. Since then, not only has Liquidity Baking under its current pair failed to improve its numbers, it has actually become worse.

USDtz upgrades made

There were however some fair points of contention expressed by bakers. We chose to take those hesitations and resolve the issues, so to make our case stronger this time around.

- Multi-sig for USDtz admin contract and collateral contract

- US-person participation not permitted

USDtz Multi-sig

USDtz Multi-sig

Shortly after the end of the Hangzhou proposal period, we fulfilled our promise of instituting multi-sig for USDtz. The attestation reports for which can be found with all audit/attestation reports for USDtz at the USDtz.com Reserve page .

USDtz US-person participation

USDtz US-person participation

Literally one day after the Hangzhou vote ended we began having meetings with US-chartered custodians. We’re proud to announce our partnership with PrimeTrust which will include custody of USDtz and other StableTez assets. We will complete our platform’s transition by March 1st at which time, the USDtz User Agreement will be altered accordingly. With this level of trust and security, we can feel confident finally removing this restriction and inviting US-person participation.

Thank you to all the community bakers who raised important questions and expressed their points of hesitation. It is in large thanks to you that we made a better product, and a better proposal this time around.

Proposal code: https://yourlabs.io/pyratzlabs/liquidity-baking/-/tree/feat/upgrade-final

To vote for Ithaca-Ipanema 2 use this command:

tezos-client submit proposals for YOUR_ADDRESS PscPJfNBhckv3mS4f6bg3VhTw9fBbR8DUcdZeSKpfgiufsgCEoE