Why adaptive inflation matters for Tezos

How to pay for security

Seignorage

Decentralized ledgers typically pay for their security through seigniorage, that is, the inflationary minting of a cryptocurrency that accrues to active validators in the protocol. This generally takes the form of a so-called “block reward”.

In proof-of-stake based systems, like Tezos, there are two costs involved in running active validators: the general operation of computers and network administration, associated with running a node and a block producing software, and the risk and opportunity cost of tying up capital in the form of stake.

We do not know, a priori, the percentage of inflation required to adequately compensate stakers for this cost. This number depends on a variety of factors, such as prevailing rates in the lending market, perceived risks, market capitalization of the currency, the cost of a setup, etc.

The “liquid proof of stake” approach

The Tezos protocol draws a separation between the accrual of block creation rights, and the exercise of these rights. Block creation and endorsement rights accrue to the holders of tez, and can be exercised by using the key they specify as a delegate. These holders are merely holders, they are not stakers since their funds are not locked or at stake in any way. Delegating in Tezos is sometimes referred to as staking, and delegators as stakers, but that is a regrettable misnomer. Block exercise and endorsements however, do require staking. In fact, the protocol is parameterized so that about 10% of the delegated tez must be staked at all times. Most proof-of-stake protocols do not draw such a distinction and instead accrue rights directly to stakers.

But how does the Tezos protocol know the right amount of inflation to incentivize enough bakers to stake 10%? It doesn’t! Instead, the Tezos protocol sets a rather high inflation rate of around 5% a year, assuming that it will be enough to incentivize just 10% to be staked. If bakers kept the entirety of the baking reward, the seigniorage would represent 50% a year for those who stake, probably more than enough to compensate for the modest staking period. What if it is too much, though? Bakers typically share part of their rewards with their delegates. In fact, they routinely share between 80% and 90% of their rewards with delegators. Since anyone can delegate at no cost, it follows that those 5% of inflation are offset by rewards. In fact, since the launch of the network, those rewards have outpaced inflation. This is due to the fact that only 70% to 80% of circulating tez are delegated.

From a pure financial economics perspective, there is no difference between a 5% inflation rate that grows everyone’s balance by 5%, a 5% deflation rate that shrinks everyone’s balance by 5% or no inflation at all. Tezos’ uses a somewhat fixed rate of inflation, but that inflation is nominal. The real rate of inflation is adjusted automatically when bakers decide how much of the reward to share with delegates.

Essentially, competition between bakers for delegation is what sets the real rate of inflation, which is what stakers are being paid. It should be clear from this point of view that increasing the nominal rate of inflation does not mean bakers would earn more. The consequence of raising the rate of nominal inflation is that bakers would start sharing more of their reward with delegates to compete for delegation. Likewise, lowering inflation would lead bakers to share less of the reward to cover their costs. There are psychological effects for delegates around certain “fee” numbers that complicate the picture, but the first order, medium term, effect of changing the inflation rate on bakers’ profit is null.

Benefits

There are several benefits to this approach

- It provides an interesting mix of security, where the stake acts as an economic incentive, and the delegation acts as a pure sybil prevention mechanism. The latter assumes that delegators have the network’s interest at heart and are able to detect and select against malicious or sybil bakers.

- People genuinely prefer getting 5% even at the cost of a 5% dilution. The term for it in economics is “money illusion”.

- In practice the system is net deflationary as it dilutes accounts who are inactive or do not bother setting a delegated.

Unfortunately there are several problems with it.

-

While a 5% inflation that grows every balance by 5% should be equivalent to no inflation from a financial economics standpoint, tax treatment may complicate the matter. While there are general taxation principles under which the tax treatment shouldn’t make a difference, tax authorities have not accepted them broadly as of yet and may never do so, the specifics can also vary from country to country. For instance, if the reward is treated as income, and the dilution at a lower rate of capital loss, this essentially creates, all else equal, a small de facto wealth tax on holders.

-

Reward distribution has worked informally so far, but regulatory requirements on bakers will only ramp up and could make reward distribution difficult in the future.

-

Any gap in delegation causes opportunity cost. Many currency market participants, such as lenders face inordinately high rates when they borrow, because they are not set up to offset them through delegation. The same goes when they use those funds in exchanges not set up for delegation.

-

The mechanism demands that users either:

- Forgo the reward

- Self custody and delegate, or bake

- Use an exchange of custodian that supports delegation

Unfortunately, not every exchange supports delegation of Tezos, and many that do are facing pressure to end their so-called “staking” offering. When that happens users of those exchanges will either:

- self-custody, and that’s great news for the ecosystem!

- forgo the reward, which may still be earned and sold by the exchange (who may be limited from sharing but not earning rewards)

- move to a different ecosystem where the opportunity cost of the exchange not participating in staking isn’t so high.

Several exchanges that do not offer rewards already still bake and sell those rewards. When that happens, their users experience the drawbacks of the dilution without the benefit of the rewards.

-

This approach does not work well when the tez of multiple people is attached to a single smart contract. This happens in privacy preserving contracts and in defi protocols. While it’s possible to delegate smart contracts, this creates governance headaches and introduces friction. More importantly, Tezos rollups should ideally be built to operate with tez as a native currency. But who is to bake for the funds locked on L1 for use in the rollup? Several wrapped tez options have emerged, most of which simply embed a type of governance or centralization that is undesirable in the first place. Ctez offers a simple alternative which does not rely on a governance model, and is purely decentralized. However, there is still to this day limited liquidity between tez and ctez. Furthermore, tez is present in most centralized exchanges and multi currency wallets, while ctez is not. The use of native tez for sapling, for defi contracts and most importantly for rollup is important, but it will not happen if doing so imposes centralization, complicated DAOs to select bakers, or a 5% a year opportunity cost.

In my opinion, the main reason why adaptive inflation matters is reason #5, followed by reason #4 and #1.

Adaptive inflation

The solution

Adaptive inflation solves these problems. Essentially, instead of relying on bakers adjusting the rewards they share with delegates, the inflation rate is adjusted automatically by the protocol to ensure that a sufficient amount of funds are being staked. It can do so in two different ways:

- by using a curve, and increasing or decreasing the instantaneous inflation rate depending on how much is currently staked… so that the rate is high if too little is staked and low if too much is staked.

- by looking at the average staking ratio and adjusting that curve up and down.

The first approach is a static approach, it reacts quickly to change in staking demand but can lead to discouragement attacks if the curve is too steep. The second approach is a dynamic approach, it can only react slowly, lest it introduces oscillations, but it’s much less prone to discouragement attacks. A combination of the two brings the best of both worlds.

With such a mechanism, instead of seeing 5% inflation with 90% shared with delegators, you might get something close to 0.7% inflation with 30% passed. At this point, the opportunity cost of not delegating would be 0.2% a year, which is much more palatable than 5%.

With delegation deemphasized, participation in delegation may drop. This affects governance, but also the security of the protocol. Hence, the proposal wouldn’t be complete with another prong to:

- Greatly increase the amount of funds required to be staked. I would suggest targeting somewhere around 50% (even though I previously suggested 20%). This bolsters the economic security of the protocol.

- Make it easy for tez holder to contribute to a baker’s security deposit without the baker taking custody of their funds and with in-protocol reward sharing

The first part is important for security but also voting, ensuring that a large fraction of tokens are involved in governance.

The second part is of particular importance to small bakers who can draw on the most important asset they have: their relationship with their delegators, to easily increase their bond and compete.

Staking and reward distribution should be as easy as delegation, with two differences:

- Funds are locked for a couple of weeks

- Staked funds can be subject to slashing if the baker misbehaves

Overall, this is a coherent proposal that addresses a long list of issues with the current staking and delegation model. The staking feature goes hand in hand with adaptive inflation and is of particular importance for smaller bakers.

Risks

There are risks that come with adaptive inflation. I’ll list a few of the important ones.

Governance

With delegation de-emphasized, we may see more weights coming purely from bakers than from delegates. I’m not especially concerned with that one. In practice, we sometimes see some delegate pushing on bakers but this is not extremely common. Furthermore, the thresholds of the protocol are set to be very conservative. The of the governance is largely to weed out bad proposals, and that can happen effectively under this model. It would be useful to implement vote override for stakers, though I don’t think it’s strictly necessary to have that one day one as the governance model is conservative and robust.

PoS security

It might be easier to accumulate stake than to accumulate delegation, and to try and discourage participation by pushing the inflation rate to very low levels. However, this is more than counterbalanced by the much higher amount of tez at stake, failed safety attacks can be slashed in protocol, and succesful ones can be slashed by forking. Economic incentives are a crisper security parameters than delegators exercising careful judgment in picking bakers. It’s a bit subjective, but I think the PoS security will likely increase overall.

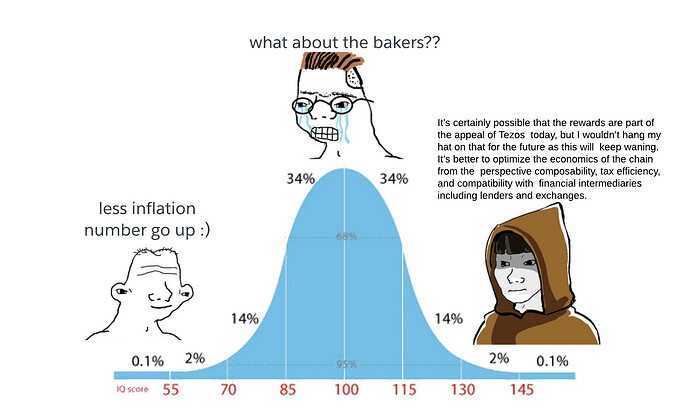

We like the rewards

This is related to the second benefit I mentionned at the beginning. It’s possible that many people hold tez because they so like receiving rewards, despite the associated dilution, though we don’t know how many. While these people could become stakers, the rate of reward would still be much lower if adaptive inflation does its job. This is a valid question.

My own feeling is that delegation became a big deal after Coinbase launched tez delegation at the end of 2019. Most people were used to coins just being these static things, and all of the sudden number-of-coins went up. At that time, every single project that wanted to build on Tezos wanted to leverage baking rewards in some way, even though it rarely made sense. However, the defi wave in 2020 quickly offered yield farming and other avenues to get rewards, and the novelty wore off.

It’s certainly possible that the rewards are part of the appeal of Tezos today, but I wouldn’t hang my hat on that for the future as this will keep waning. It’s better to optimize the economics of the chain from the perspective composability, tax efficiency, and compatibility with financial intermediaries including lenders and exchanges.

Conclusion

There is ongoing work by core development teams to develop the concept. The general thinking is that if it is included in a proposal, the activation of adaptive inflation would be separated from the adoption of the proposal, relying on a separate vote with similar quorum and thresholds, so as not to block the protocol upgrade process with any debate on the matter, but so as to be ready if and when there is enough appetite to go fot it.