I never said LPs were stealing the 262,800 TEZ a year. They are not stealing anything. I said 2,628,000 TEZ a year from fp are distributed to all TEZ hodlers (which includes delegators) with a 0% baking fee the moment is burned.

Let’s do the following, I can calculate exactly how much wealth transfer is going to happen at my bakery due to this new policy, putting my bakery as example, which is at full capacity:

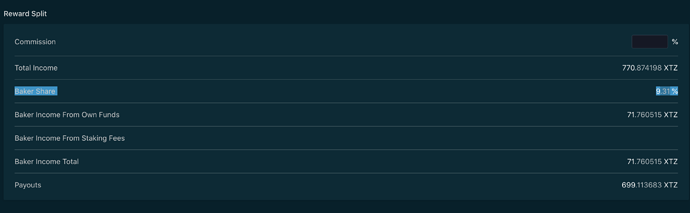

Baker share of the whole staking capacity is 9.31%, by delegators have the rest 90.69% share. Meaning that only 9.31% of the block reward is mine and 90.69% of the block reward is for my delegators.

Here is my baker share if you need proof

Without liquidity baking:

thirty seconds block reward of 40 TEZ (100% of the block reward)

Taking my 9.31% share, 40 * 0.0931 = 3.724 TEZ from that is mine WITHOUT a baking fee, because I don’t charge to myself a baking fee.

Now 40 - 3.724 = 36.276

Now, I subtract the 10% baker fee: 36.276 * 0.10 = 3.6276 (this is what I earn due to the baker fee).

Now, 36.276 - 3.6276 = 32.6484, this is what I will distribute to the rest of my delegators with the baker fee subtracted already.

My total earning from the 30 second 40 TEZ block are = 3.724 + 3.6276 = 7.3516.

The earnings of my delegators to be distributed are = 32.6484

Now with liquidity baking

For the 40 TEZ (94% now of the TEZ printing machine) it all stay the same.

I earn 7.3516 and my delegators earns 32.6484 with the fee substracted already.

Now let’s see what happens with the 2.5 extra printed TEZ.

Subsidy of 2.5 TEZ → LP’s

Note: lp’s will either stake it right after they earn it, or dump it, buyers of that dump will also probably stake it

Scenario 1)

Traders recover 2.5 TEZ → Burn = redistribution of 2.5 TEZ to all hodlers.

NOTE: burn is something not anyone can grasp in their minds, burn means redistribution of a quantity equally to all hodlers

My previous earnings of the 40 TEZ block were 7.3516

2.5 * 0.0931 (my staking share) = 0.23275

7.3516 + 0.23275 = 7.58435

The previous earnings of my delegators of the 40 TEZ block were 32.6484

2.5 * 0.9069 (their staking share) = 2.26725 TEZ

32.6484 + 2.26725 = 34.91565

So my total earnings and the earnings of my delegators in this scenario are:

7.58435 vs 34.91565

Scenario 2)

Traders recover 2.5 TEZ → Reimburse to bakers

2.5 * 0.0931 (my staking share) = 0.23275 (I don’t apply a baking fee to myself obviously)

Now, 2.5 - 0.23275 = 2.26725

Then I subtract a baker fee of 10% to that amount, so, 2.26725 * 0.10 = 0.226725

So, now that I subtracted the baker fee, I need to rest it from the 2.26725 - 0.226725 = 2.040525

2.040525 with the 10% baker fee already subtracted that I will distribute to my delegators.

My total earnings of that 2.5 block would be 0.23275 + 0.226725 = 0.459475

2.040525 of the 2.5 TEZ will be distributed to my delegators.

OKEY, now let’s sum up all the profits of scenario 1) and compare them to scenario 2)

Scenario 1) profits

My baker: 7.3516 of the original 40 TEZ block + 0.23275 (of 2.5 TEZ of scenario 1) = 7.58435

Delegators: 32.6484 of the original 40 TEZ block + 2.26725 (of 2.5 TEZ of scenario 1 ) = 34.91565

Scenario 2) profits.

My baker: 7.3516 of the original 40 TEZ block + 0.459475 (of 2.5 TEZ of scenario 2) = 7.811075

Delegators: 32.6484 of the original 40 TEZ block + 2.040525 (of 2.5 TEZ of scenario 2 ) = 34.688925

THE END RESULT IS:

Scenario 1 where the trading fee is burned, I earn 7.58435 and delegators earn 34.91565.

Scenario 2 where the trading fee is reimbursed to bakers, I earn 7.811075 and delegators earns 34.688925.

The result is that there was a WEALTH TRANSFER of 0.226725 XTZ from baker to delegators due to this policy EVERY BLOCK. That’s 2.9% of FORCED wealth transfer every block to delegators.

Delegators are not stealing anything either, is the result of bakers forcing other bakers to redistribute wealth due to this hidden TAX, they are reducing their own incentives.