What’s the incentive that someone has to build and maintain a front-end? A more likely scenario is that sketchy front-ends will pop up and steal users Tez when they try to deposit liquidity.

A frontend is way more convenient but everything can be done without a frontend either with BCD or two lines of python code with pytezos. It’s not for everyone but you don’t have to be an expert in anything ![]()

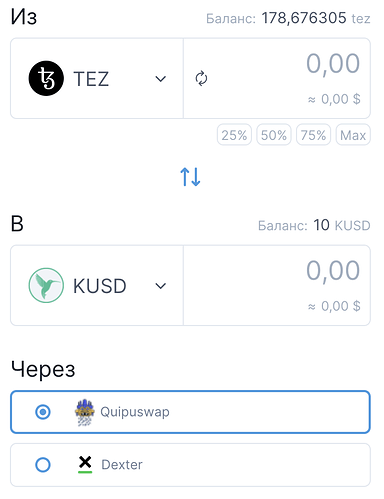

Besides Temple has integrated swaps on quipuswap and dexter recently, pretty sure they’d be happy to integrate this contract as well

The fact that you have some legitimate questions about it, which I’ve answered and am happy to continue to, does not make it “half-baked” or undocumented. There is documentation for it included with the release and I’ll be adding some specifically for the CPMM very soon in the dexter2tz repo.

A whole team at Nomadic has been poring over it for months now and has been developing a new testing framework and addition to Mi-Cho-Coq in order to test and verify properties we haven’t previously been able to: Nomadic Labs - Progress report on the verification of Liquidity Baking smart contracts. It is more than stable at this point and we take security and quality control around it extremely seriously given the amount of funds involved.

I really don’t see the lack of a frontend at the time of proposal as such a big issue (as would be the case had we not updated the baker to be able to set the escape flag). Frontends can easily be added by multiple teams, including existing wallets, and I’m sure TF would be happy to fund this.

@sophia can you please spend a min and explain part of LB related to the escape hatch to me, who unfortunately had to quit school to provide for my familia trading shitcoins.

I’d like to know how to continue this line:

about 693 blocks if everyone signals, 980 blocks if 80% do, 1790 blocks if 60% do, etc.

Given the fact that CB, Binance, Kraken and TF represent about 40% or the rolls and we can’t really expect them to include a flag unless it’s harmful for the ecosystem, a realistic amount of blocks we would be able to get is probably slightly less than 50%

I like the idea of TF funding Liquidity Baking. Exactly what the foundation endowment from ICO should be for (to be used to promote Tezos network) as opposed to further dilution of Tezos holders. Did anyone try raising a proposal to TF requesting funding for LB? Simple, non-controversial and highly beneficial to Tezos network. What stops TF from doing this?

If less than 50% include the flag, the subsidy stays on. In the case of a security issue, I assume TF and maybe Coinbase would activate the escape flag.

This legal commentary by @AlexL might be informative: Liquidity mining on Tezos - #57 by AlexL

Now I see why it’s called the “escape hatch”; my apologies I’m not the sharpest validator on the block.

Looks like there has to be a huge security issue or similar, minimum to have any chance of turning LB off before the 6 months have passed. The bakers who have voted to include this proposal into Tezos will in fact not be able to turn it off so easily, or as easily anyway. We will require a larger and more coordinated effective response than the quorum for the promotion vote itself. Here I take into account things like educating people how to even use this flag, convincing them it’s important enough to do, trying to recruit exchanges than never vote or that vote pass which is all of them and some other smaller devils in the details.

I hate, hate, hate to be this guy but…

Above it sounds much easier to turn off than what it will really require, which is a “hair on fire” type of emergency. I have seen many people imply the process of using the hatch to be a lot easier than it will be if we actually want to use it in the future. This is something bakers should be mindful of.

Having said that, I still maintain my full support for the LB proposal as-is and I am not voting to explore the other ones because I believe we must try this idea and not only for the obvious reasons that readily come to mind.

I’m strongly against this proposal, and have been discussing it in the Kolibri discord and will post my thoughts in here as well. I’ll approach my argument from a few angles, the first being the target audience for this proposal.

What exactly does this proposal aim to accomplish. We’re incentivizing something, but what is that “something”? We’ll separate Tezos users into a few separate users:

The Average User - This is someone who is an everyday person, someone who can maybe afford a few hundred to a few thousand Tezos, they delegate their stake and have no issues getting liquidity in and out of the ecosystem on account of their small size.

The Institution - This speaks for itself, but this is someone who wants to move millions of dollars worth of Tezos at a time.

The Rich DEFI Power User/Guru - This is someone who may or may not be opposed to using a CEX, has hundreds of thousands or possibly millions in liquidity they want to bring to Tezos.

With these users defined, let’s consider who this proposal’s additional liquidity is benefitting.

First we’ll examine the Average User. A large portion of this type of person will have no problem using Binance/KuCoin/etc. Exchanges which have no KYC requirement, and have trading fees at or below what this contract would charge. These exchanges have more than enough liquidity to support the kinds of trades they want to do. If they were adamantly against using a CEX, they could easily obtain a few hundred or thousand dollars by using the Wrap Protocol or Stakr and trade the wrapped tokens for Tezos. Therefore, there is nobody in this group of users that is served better by this proposal.

Second is the Institution. These institutions, for the most part, want to be as aboveboard and law abiding as possible. In general the law is on their side. They have no issues registering with CEXs like Coinbase/Kraken/Binance and doing the necessary KYC. If any of these institutions want to obtain XTZ, they can simply trade it OTC. I’m not sure of what the liquidity looks like for the OTC markets, but I find it hard to believe that they would want to obtain such a large amount that they’d prefer to do a whole other KYC process to obtain tzBTC. It’s not clear that this contract will have less slippage than Binance or Coinbase anyway.

Third is the Rich Defi Power User. If the Rich Defi Power user is not opposed to using a CEX to make trades, you can trade dozens of BTC worth of XTZ on these CEXs with lower slippage and fees than would be expected on these contracts (Binance has under 0.1% fees and almost no slippage for orders of 1-5 BTC worth). And if they are opposed to centralized/custodial/KYC solutions, then it is a moot point since tzBTC is also a centralized/custodial/KYC solution. So they will have to use a different avenue regardless.

In short, this proposal only possibly benefits institutional traders, not the average Tezos user. Once the defi ecosystem is built out, institutions will come whether they like it or not simply because there is opportunity and money to be made.

Next, I’d argue that while this liquidity may have been necessary when it was first proposed, it is becoming less and less necessary by the day as Quipuswap liquidity improves for a number of products, and as new projects and alternative DEXes continue to launch. There’s already been a near order of magnitude growth this month in the amount of liquidity available on Quipuswap and there’s no reason to believe that it will be slowing down, with many more farms scheduled to launch, kUSD debt ceiling continuing to rise, etc.

Thirdly, I believe that as best as we are able, we should modularize our governance proposals. That is to say that we should vote on as granular of issues as is reasonable. In my opinion, this proposal would not be able to pass if it were to stand on its own. And the only reason it has a chance of moving forward is that it is coupled with such important updates to the Tezos network.

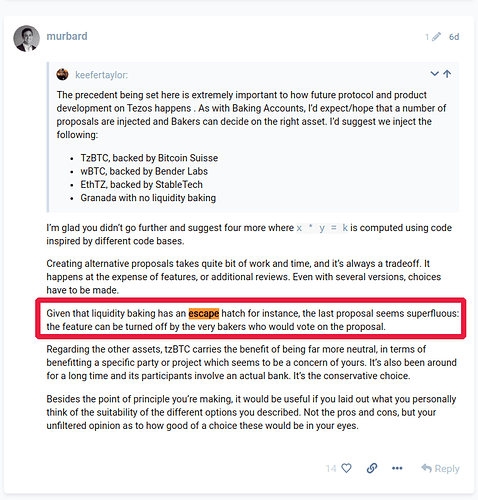

Fourth, this “escape hatch”. Even if it were easy, I think it’s very unrealistic to assume that LB would be disabled any time before its 6 month sunset window. There is simply too much inertia. And from what I’m reading, this “escape hatch” doesn’t much work at all. IMO this is all the more reason why this proposal needs to be voted for on its own merits.

Finally, the choice of tzBTC. Setting aside any connections to TF, saying it has “elevated prestige” is a little laughable. I don’t want to be a pessimist but nobody cares about tzBTC and there isn’t demand for it. If wBTC (on Ethereum) required KYC nobody would use it and no defi projects would want liquidity for it.

To clarify my point here: How does incentivizing tzBTC liquidity encourage onboarding to Tezos? Liquidity isn’t the reason there is no XTZ demand, it’s that nothing has/had been built yet. It’s not a chicken and egg problem. If you build things, liquidity will show up, but the reverse isn’t necessary the case.

Secondly, I can’t be the only one who finds it concerning that people are just kind of sweeping the issues with this proposal under the rug. The proposal is interesting and one of the cool things we can do with governance, but it doesn’t provide clear and obvious benefit, they are speculative at best, so why are AB + others so adamantly in support of it and ignoring its flaws and tradeoffs? Shouldn’t we let a somewhat experimental and controversial proposal stand on its own weight?

Yep, even TF would be enough.

But if LB does not meet expectations in terms of liquidity or in case of any other minor flaw,

we’re not gonna be able to cancel it

The Bakers have spoken.

Tezos protocol will solve some real problems. Liquidity, faster blocks, and cheaper gas.

They have not, as they were not able to. This is precisely (one of) the points we’ve been discussing for days now.

I thought “men lie, women lie, but numbers don’t?”

Granada is voting heavily in favor as opposed to Granada without LB. Keefer and Luke have been vocal on all channels pushing their narrative but at the end of the day, Bakers voted rationally by reading facts rather than made up speculation or conspiracy theories.

I think you have not understood the discussion if this is your conclusion, but I have nothing to add to what has already been said so I will leave it at that.

Granada with LB has 75% of the votes, which I think was the point being made.

Last thing I’ll mention is that this proposal can’t even serve the only users who would want it anyway. 2.5 XTZ simply isn’t enough APY to produce a large enough liquidity pool that slippage still wouldn’t be an issue.

Or they heard about Grenada update, looked on tzkt and tzstats at the proposal with the name Grenada, chose the top one, and upvoted it.

If you want to use speculation to support your argument, then this discussion won’t go anywhere.

You might want want check your math again. You are extremely misinformed.

Ironic you say this, because the entire proposal is based on extremely speculative benefits benefitting an invisible and unnamed group of users who nobody can seem to quite define.