What type of applications do you foresee actually being useful on the back of this protocol upgrade

So LB doesn’t seem controversy at all. Only a handful of people voted for no LB while Granada with LB destroyed it.

“not controversial”

It’s the only proposal thusfar that has had significant pushback and alternative proposals made without it. And also one of the most discussed governance proposals ever. Nope… not controversial at all

“Men lie, women lie, numbers don’t.”

Only push back was by 4-5 people, it was only discussed as much because 95% of the discourse was between Luke, Keefer, and Arthur carrying it over multiple channels and making it personal.

Then you have Tezos wake n bake and his alt accounts discussing bullshit economics of LB.

Sorry folks but an actual controversial proposal should have been closer in voting and LB is winning by a land slide.

I hope in the future we have two actually good proposals by different dev teams and we have a hard time deciding because both have good unique features. Not this bullshit, hidden agenda drama.

Those are strong accusations, my friend. You are the one with the new account which first post was in Jun 1.

The mathematics are there, those are not BS economics, baker incentives will be reduced you like it or not. Mathematically proved. You don’t have to be a genius to know that bakers will be deprived of applying the baking fee to 6% of the new supply generated from our printing machine. You are the one against numbers.

I really hope the people implementing pushing and vouching for LB will fully think of the potential legal ramifications it can bring of having a defi instrument on a protocol level . Please refer to this post which was released yesterday.

Walking on a thin line here if my understandings of this article is correct

Our advantage here is that tzbtc require KYC no? So it can be regulated by the US authorities. But idk tho, i might be wrong.

First and foremost, there are a few things wrong with Dan Berovitz’ understanding of defi. Secondly, it doesn’t inspire much confidence when he justifies his position by relying on a quick google search of what “defi” is.

I think you are rightfully justified in being cautious about implementing LB at the protocol level, however, I am not sure how this is a “defi instrument” on the protocol level as it’s only providing a subsidy-like incentive to certain LPs which are built on top of the protocol layer. The leap you’re making here is that at the core protocol level is launching a defi protocol which is not happening, if it were so, you could basically say compound/maker dao etc are built on the eth core protocol when in reality they’re not as they’re based on smart contracts. Unfortunately what you’re seeing right now is what happens when regulators talk out of their ass in subjects that they’re unfamiliar with, which is a tragedy. Luckily for us (crypto community), the main regulating arm/the main sister agency SEC is led by former CFTC chairman Gensler who has a much better understanding of defi and crypto in general.

In short, as of right now, I wouldn’t pay much credence to Berkovitz as CFTC does do some regulating, but in terms of crypto regulations, I would estimate close to ~95% of all regulatory actions are done by the SEC, which should tell you something.

All im saying is to tread lightly . As we have seen in the past, things can be used against you from the past. Laws, and regulations change all the time, the fact that we are fiddling with something that the regulators have a huge magnifying glass over, puts us in a huge issue of potential risks. Looking at how conservative and cautious Arthur and the TF have been with regulations and the regulatory bodies in the past , this protocol change looks like a major over sight and extremely risky due to the uncertainty of what can come. If for any chance Defi is labeled as illegal and a crack down happens, god forbid, expect major scrutiny and delistings the same way we saw ripple get rekt even before it was actually labeled a security. These exchanges and entities that invest or support this platform will give 0 fucks what you are trying to accomplish or who you are if they feel you are a liability to their platform.

P.S. Let it be known that if for any reason that hammer comes down, i voted no and that is forever in the blockchain.

I agree that we need to tread lightly and try to read the tea leaves when chair persons of regulatory authorities speak, however, one of our strengths is that we are uniquely situated due to our ability to upgrade/amend in a short manner of time so that if they do take a stance against the protocol’s interest we can quickly change it up.

100% agree with you, the one flaw in this train of thought tho is what you do going forward does not change what you have done in the past or have done in the past. As we saw with exchanges like bitmex or coinbase and situations like ripple, they looked at past events and had rulings on those events presently. You are still subject to your actions in the past just as much as the present and the future. The Statue of Limitations with SEC is 10 years. So anything in the past 10 years that they might deem illegal is still subject to be looked upon.

As promised, I remained neutral on during the proposal phase until near the end, at which point my Baker Tessellated Geometry chose to upvote Granada with Liquidity Baking. I’ve written my rationale for that here, along with my assessments fo the alternatives assets and no-LB alternative (I know @murbard and others asked for this and it’s a fair question to ask).

Given the information at the current time, I believe it was prudent to advance Granada with TzBTC liquidity baking to the exploration phase. I am excited to see discussions continue to take place about the proposals merits, and there are certainly interesting opinions on both sides and I expect the debate will continue to evolve in coming weeks.

A few other point son this thread I want to bring up:

This is a technical detail that I didn’t realize, and I’m disappointed at the way the escape hatch was presented on this thread. It appears that in practice, it would be really hard to activate an escape hatch.

Large exchanges are unlikely to be able to activate a flag, both because their infrastructure is fairly complex and because there’s likely a (potential) legal liability with them taking an opinion on a protocol feature.

I can only only imagine that the Foundation would flip the switch if the economics didn’t work as expected, or if there was a technical issue. At this point, I’ve spent a lot of time looking at the Liquidity Baking code and it is well written and very well tested, so I’d be very surprised if it had a technical issues. This thread would indicate that at least one member of the Foundation firmly believes in the economics.

This is a shame to me because I feel like this thread made it seem like the escape hatch was easy to access and I perceive that a few bakers have used this as justification as a reason why they support liquidity baking. I think it’s important to call this out directly so that folks realize what they’re voting for. I don’t think most bakers are reading deep into the documentation and constants in the code that you would need to in order to understand the practice here (even though I think they should!).

I certainly think that the counter proposal was spread through unofficial public / private channels fairly well. I do think it’s unfortunate that most official channels didn’t pick it up, but I am encouraged that engineers did stand up a test net.

I do think that this conversation would have been a lot easier if the counter proposal came from an “official” source, rather than anonymous engineers who (presumably) feared retribution, but I think that’s a problem that we can tackle another day.

I don’t however think that it is fair to say that the protocol passed the proposal phase due to an unfair election. I certainly think it could have been a more level playing field, but ultimately it wasn’t that close of an election.

If there really were enough people who were simply not aware, it would be easy enough for them to vote down the proposal in the Exploration Phase and for us to advance another proposal that will have broader support.

Thanks for your answers, Sophia. I appreciate your insight.

This doesn’t comport with the rest of your post where you continue to imply collusion between TF and the tzBTC consortium, which would be unethical on the part of Arthur and TF.

I think that asking for transparency and implying collusion are separate concerns, which is why I went out of my way to explicitly state that and offer a public apology if my words were not clear in previous posts.

I’m advocating that we, as a community, should hold ourselves to a high standard in this regard, not advocating that I think there’s some form of collusion. Even if there was collusion, I am not naive enough to think that we’re going to somehow expose / investigate / litigate that in a community driven, public, internet forum.

Ozcam’s razor applies here: Perhaps I’m simply trying to make it easy for the Tezos Foundation to set a high standard of disclosures by asking easy questions to answer, and thereby removing the conflicts of interest angle from this debate.

With all that said, I do think it is the community’s right to ask/expect reasonable disclosures of conflicts of interest (and it’s also the Tezos Foundation’s right to not engage should they think that’s the best path for them). I personally don’t understand why there’s so much pushback on what seems to be a non-controversial request.

I have seen both public and private discussions where others are repeating this request for transparency, and I’m glad the community is pushing on it.

I’ll respond to a few of your points below (quoted for brevity):

I do not financially benefit from any of their investments other than through my continued employment at an organization they fund. Suffice to say, it is extremely far fetched to imagine I colluded with the tzBTC consortium.

Thanks for stating that! This represents a simple, complete and useful statement that expresses transparency.

I appreciate you taking the time to say this, and for the avoidance of doubt, I certainly don’t think you are colluding with anyone.

I will also note that there’s one group I’m fairly certain does not care about this elevated prestige: anyone associated with tzBTC. As Arthur already explained, the institutions behind it are large enough the minting fees mean nothing to them. And the contract was developed quite some time ago as a contract job by a consultancy who does not stand to financially or reputationally benefit from it at this point. Finally, tzBTC already has elevated prestige compared to other assets from its significant first-mover advantage.

Thanks for stating this as well. I think that’s a great explanation of the state of the world and provides some more details to the folks reading this that perhaps were not wildly known.

I don’t believe you think Arthur did either, which is why it’s disappointing you continue to concern troll about it and claim you’re innocently arguing for transparency. Of course, I can’t argue against TF releasing this information because it would appear as if there’s something to hide. But you have no evidence that any relationship between TF and the tzBTC consortium is relevant to the choice of tzBTC for liquidity baking.

My point is that summarizing the relationship between these entities as a “price of two beer” relationship isn’t a complete picture.

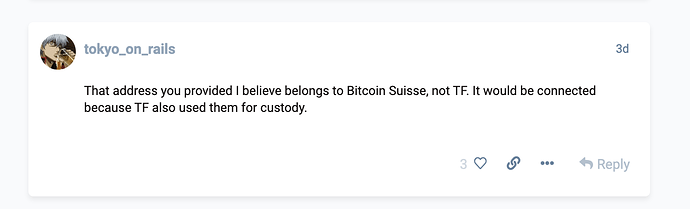

A series A investment typically comes with a price tag higher than a few beers. It’s also been stated in another thread on Agora that Bitcoin Suisse is the custodian for the Foundation:

(Source)

Presumably the cost of custodying 600M of Bitcoin [2] is also higher that two beers.

I do think these facts are relevant to the discussion about giving an asset elevated prestige and I think it’s in everyone’s benefit to disclose them openly.

I wish we would be totally transparent that these are / are not the only relationships between these entities.

Lastly, I’ll state again that conflicts of interest can be okay if they’re disclosed properly. It’s okay for entities or people to make money. Everyone has a rent/mortgage to pay, or needs a way to feed themselves dinner this evening.

If the Tezos Devs write a great protocol, it is absolutely fair that they get paid for doing so. If the Tezos Foundation makes a great investment and it appreciates in value that’s okay too.But we should be explicit about these relationships when picking a “winning” asset and advocating for it [3].

In conclusion, I’m advocating for transparency and responsible disclosure. I do perceive the transparency and pushback that this request has received is hurting public perception of this proposal. I’m also pushing us to do this proactively and better in future protocol proposals, since I don’t think a 300+ post Agora thread is serving anyone at this point.

[1] I realize that Corey (to the best of my knowledge) works at Tezos Commons, but I assume he wouldn’t make a purposefully misleading statement.

[2] Tezos Foundation Annual Report, pg 44.

[3] Regardless of if that asset was chosen because it was the best option, only option, chosen by a coin flip or otherwise, and regardless of if the asset already has prestige

That statement was an assumption on my part, as we had also observed that address and its behavior in the past, and found it to be Bitcoin Suisse. I don’t have any knowledge about any custody relationship, should have worded it differently. To me it seemed like merely a medium used between the bakers/vested funds and wherever they needed to send Tez, as the majority of their Tez is more difficult to access.

I never said anything about custodying their Bitcoin, so you’re also making assumptions by using the maximum values that you could imagine. I was referring to the observed Tez in that thread only, which would not be a large amount as most was in the bakers/vested accounts.

Regardless, it’s sad to see you’re still trying to insinuate these things rather than focusing on your core argument itself. In all seriousness, I think you and I both know there was no sinister reason for choosing the pair.

Maybe we just need to wait until there is a liquid, stable, NON-KYC, non-custodian asset to pair with TEZ, not just rush into liquidity baking like that.

“Two beers” was used to compare the minting fees for the newly wrapped bitcoins relative to the total revenue of the organizations in the tzBTC consortium.

Most of what you’re asking in this post has nothing to do with liquidity baking, but when you ask for this information in this context there’s an implication that it does.

I also want those two beers, share the beers between all of us. What’s good for the goose is good for the gander.