This proposal describes a simplified, version of Checker in the special case of tez collateralized by tez. Since 99% of the complexity of Checker comes from handling potentially faulty oracles and liquidation auctions, the resulting system is quite simple. There is no governance involved, the system is completely mechanical and straightforward.

Target factor

The target factor represents the number of tez that a ctez should be pegged to. It starts out at 1.0, but changes over time. Typically given the current state of baking on the Tezos chain, this target factor might be around 1.05 or 1.06 after a year representing the accrual of more tez through baking. The target evolves over time based on its drift.

Drift

The drift is a system-wide parameter which varies over time. The relationship between the target and the drift is as follows:

target[t+dt] = target[t] exp[drift[t] * dt]

Note that given realistic values of drift and dt, in general target[t+dt] = target[t] * (1 + drift[t] * dt) is an excellent approximation and sufficient for our purposes.

Vaults

A vault is a smart contract following a certain pattern and controlled by a single user. It lets them place tez in it, pick any delegate they want, and mint ctez.

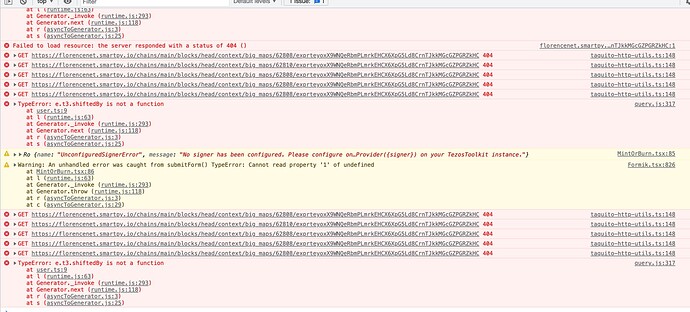

Liquidation

If a vault has less tez in collateral than the number of outstanding ctez outstanding times the target factor, times 1.01 (as a safety buffer), then anyone can grab the collateral in that vault (or a fraction thereof) by sending to it the outstanding ctez (or a fraction thereof) which is burned.

CPMM

A constant product market making contract (similar to uniswap) allows people to exchange tez for ctez. It can also be queried to learn the implicit rate of ctez in tez. Ideally, this rate is the target factor, but this informs us of any deviation. There is no baker for that contract.

Each time the CPMM is called the drift, and the target factor for ctez, are adjusted.

If the price of ctez implied by the CPMM is below the target by over 1%, the drift is raised by one percentage point per fractional years per fractional days since the last adjustment. If the price of ctez is more than 1% above the target, the drift is lowered by one percentage point per fractional years per fractional day since the time of last adjustment.

Given that there’s almost no real movement in this pair, it doesn’t need a whole lot of liquidity to function effectively, just a tad enough that the rate read from the contract isn’t too noisy, hence the lack of baking shouldn’t be a huge hindrance.

Why does it work?

If the price of ctez remains below its target, the drift will keep increasing and at some point, under a quadratically compounding rate vaults are forced into liquidation which causes ctez to be bid up to claim the tez in the vaults.

If the price of ctez remains above its target, the drift will keep decreasing making it profitable to mint and sell ctez while collecting baking rewards.

The drift is a mechanism that automatically discovers a competitive rate at which one might delegate.

Why it’s useful

ctez can be used directly in smart-contracts that would normally pool tez together without the thorny question of “who’s baking”.