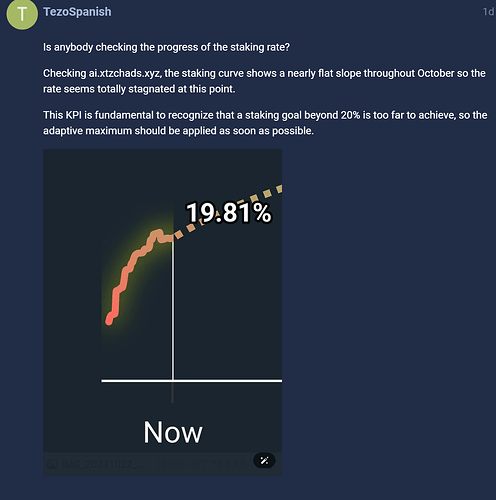

One of the topic that sparked intense debate among community members in the most recent Tezos upgrade is the adjustment of staking and delegation rewards.

According to the current ongoing proposal, delegators would receive only one - third of the rewards of stakers . The aim of the members who proposed this is to encourage XTZ holders to switch from delegating to staking, thereby enabling Tezos to achieve a 50% staking target.

Will the goals of the community members who proposed this come true?

That is difficult to succeed

I will illustrate this with a case of a baby incentive plan. For example, many Asian countries are currently facing issues such as low fertility rates and population decline. Government administrators say, “Hey, community members, the government will implement a baby incentive plan, providing a monthly subsidy of $600 for living expenses for each child.”

However, after the implementation of the baby incentive plan, the birth rate continues to decline. Work pressure, high housing costs, education costs… all make people reluctant to have children.

Similarly, staking and delegation are also affected by multiple factors. For instance, the consensus level of XTZ holders, Tezos - based ecosystem applications, XTZ price expectations, staking and unlocking times, market attention, and so on.

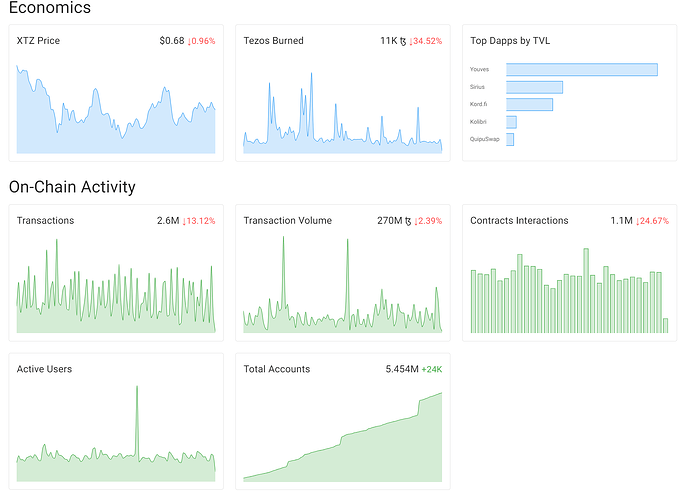

The growth of Tezos in terms of market capitalization, on - chain users, developers, Total Value Locked (TVL), and dapp applications is slow. Additionally, over the past month or so, the XTZ staking rate has stagnated, indicating that current XTZ holders have low expectations for Tezos’ development and price. Two years ago, on the CoinMarketCap website, Tezos was ranked around 50th, and currently, it is ranked around 100th. The trading volume of XTZ on exchanges is also extremely low.That is difficult to succeed.

If Bitcoin had staking rights similar to Tezos’, it is expected that Bitcoin holders would quickly reach a 50% staking rate. This is the secret of the staking game.

The damage caused by the adjustment

A. It suffocates the development of Tezos’ DeFi protocols in the ecosystem.

Among major PoS networks, the total value locked (TVL) of Tezos’ DeFi protocols is currently very low, with a TVL market value of 50 million US dollars. The TVL market value of Ethereum is about 46 billion US dollars. If it is further reduced to 33%, it will deal a further blow to the weak Tezos DeFi ecosystem.

There is a Lego mechanism in DeFi protocols. Various protocols will combine with each other to produce an ecosystem effect.

A weak DeFi protocol ecosystem will hit those developers who hope to participate in Tezos-related DeFi protocols, making it difficult to produce the DeFi Lego effect. Some innovative RWA applications will also choose networks with more liquidity.

B. The gap between the weights of delegation and staking rewards is too large, leading to power inflation in the Tezos community.

Since the staking rate remains stagnant, over a long period of time, a small number of stakers will be able to obtain more XTZ rewards and have more power in community governance.

A balanced solution

Solon, an ancient Greek sage, once said a word that one should avoid going to extremes. In ancient Greek history, Solon is famous for balancing the different interest demands of the community

The Tezos community needs to adopt a balanced strategy to protect the decentralization of the Tezos community while also protecting the development of the Tezos application ecosystem.

Delegation in the Tezos network system falls into two situations. One situation is delegation at a common wallet address, and the other situation is delegation at a smart contract address such as in DeFi. XTZ delegated at a common wallet address can be freely transferred. XTZ delegated and locked at a DeFi contract address can also be freely transferred, but the transfer cost is higher.

For example, in the Kolibri protocol, users who mortgage XTZ to borrow kusd rarely transfer the XTZ in the smart contract to stake. Because they need to repay the kusd loan amount and interest before they can transfer. In addition, staking also has the loss of opportunity cost. However, if the delegation rights of DeFi smart contracts are further reduced, users of the protocol may choose to stake. This will draw liquidity from the DeFi protocol.

Currently, the most promising solution is to set the delegation reward at a common address to 50% of the staking reward and set the delegation reward for DeFi protocol smart contracts to 80% of the staking reward.

Since the value of TVL in Tezos DeFi protocols is not significant, it will not have a major impact on stakers’ rewards.Of course, as to why it is 50% and why it is 80%, the community can conduct more qualitative research.

However, protecting the decentralization of Tezos while protecting the development of the Tezos application ecosystem, especially the protection of DeFi protocol liquidity, is a basic thinking principle before formulating the rules for XTZ reward release.

These ideas may involve cost implications and technical challenges, and I approach this discussion with a humble mindset. I welcome your thoughts and encourage open dialogue without any pressure or reservations. However, I ask that any expressions of opinion be grounded in rational analysis based on factual evidence.