Do not reduce unstaking time (If anything, increase it)

If we cut unstake time from 4 days to 12 hours, we will not improve Tezos staking. We would erode the very commitment device that converts volatility into conviction and we would be replacing it with the very bank-run dynamics that the unstaking time period is meant to prevent.

1. Purpose of unstake time: retention, not convenience

The unstake window exists to induce longer commitments. Entry is near instant, exit takes time. That asymmetry is deliberate. It is how retention works in behavioral finance. People align their beliefs with what opportunities are available, not with what is optimal for them. This is only supercharged in a fight-or-flight situation.

In times of market volatility and even momentary panic, the 4 day buffer induces participants’ sense to accept that their tez (even if they unstaked it ‘now’) will not be liquid in time. That simple fact changes their mindset. With a long enough unstake time, most do not even consider unstaking it because they know the moment will have passed. That is, it precludes them from even thinking of rationalizing unstaking their tez. Others even rationalize their past choice to stay staked and even scale it, reminding themselves that they were smart to commit.

If we collapse that buffer to half a day, we not only mitigate the effect, but we actually reverse the effect. In moments of panic, people scan their portfolios and ask what they can liquidate first. Their minds do not go to the weakest asset objectively, they go to the asset that is nearest to liquid. By competing on shortest unstake, we induce people to treat Tezos as the weak link in their portfolio, not because it truly is, but because it is the easiest to exit. In that way, short unstake times manufacture fragility and create an induced sense of no confidence at the very moment when confidence matters most.

2. Misuse of Incentives

The argument for shorter exits is that it might encourage more staking. That misunderstands how incentives work and their role in these ecosystems. The reward is the incentive, and incentives are meant to override friction.

The value advantage is frontloaded. People everywhere in finance accept lockups, from bonds to CDs, because the return justifies the friction. Other blockchain ecosystems’ lockups range from several days to several weeks. Those blockchain ecosystems are not competing on the ‘shortest unstake time’ for a reason. Reducing unstaking friction does not strengthen sustainable adoption, it weakens it.

(I wrote more about optimising incentives use in the ecosystem, here).

3. Misuse of Feedback Loop

When asked, users will always say they want shorter unstake times. But that feedback is a trap and not a reason to actually reduce it. If you reduce from 4 days to 12 hours, they will still say it is too long, because what they want is instant liquidity. Appeasing that demand is a losing game.

In behavioral finance terms, reducing unstake time would amplify loss aversion and liquidity preference. It would condition participants to keep Tezos in the category of assets they can liquidate first, which undermines its role as a commitment asset.

The right metric is retention, not appeasement. The people who refuse to stake their tez, or more of it, unless the unstake window were reduced are not the people nor the mindset we should be chasing.

By competing on shortest exit times, we do not increase confidence. We manufacture no confidence, because we teach participants that Tezos is the nearest-to-liquid asset and therefore the one to liquidate first in a downturn.

What the individuals giving this feedback are really saying is: you are not making it easy enough for me to exit this system and sell. In other words, I like getting rewards for free, but I also want the ability to dump as quickly as possible, and you’re not making that easy. It is not wise to ask them what they want, because they will tell you things that, if acted upon collectively, create the very conditions of a bank run.

4. Risk of Capital Flight

A reduced, 12 hour window invites capital flight. Liquidity signals weakness before and during market panic. Liquidity and confidence become inversely linked. Traders and automated systems will identify Tezos as the fastest stake to unlock and will front run exits. That anticipation itself triggers cascades.

The danger does not stop there. Once traders and bots recognize this pattern, it becomes part of their standing strategy. The rule becomes automatic: unstake and sell Tezos first. That makes every market downturn disproportionately steeper for XTZ than it needs to be, because the exit is no longer a decision, it is pre-programmed behavior.

Capital flight also damages perception. Markets would remember which assets bled out fastest. If Tezos develops a reputation as the chain where liquidity always runs first, that stigma persists long after the panic ends. It becomes part of how investors categorize Tezos in their mental map of risk. If there’s any whiff that the market might stumble short term, the precaution will be to unstake and sell XTZ (just in case).

There are operational consequences too. Frequent unstake churn undermines baker stability. Staking positions rotate in and out more often, which erodes predictability of rewards and makes it harder for bakers to plan. That weakens the operator base at the very moment when the network needs it strongest.

Finally, capital flight at the staking layer spills over into DeFi. Large amounts of tez unstaked quickly are more likely to be dumped into liquidity pools or exchanges, destabilizing pairs and creating slippage. What starts as a staking design choice cascades into price volatility, DeFi fragility, and reputational damage all at once.

5. Attribution

The real adoption barrier is not unstake time but marketing. Most tez holders still do not know that staking exists or how it works compared to delegation. It’s hard to remedy, and will take more time and iteration, but if we try to compensate for missing awareness with protocol changes, we would undermine the very commitment mechanism that staking relies on, while undermining the work that actually matters.

If we shorten the unstake window, we additionally lose the ability to measure whether it made any difference. Any increase in staking afterward would be impossible to attribute clearly, because many other factors could be driving it. We would lock ourselves into a fragile design without ever proving it was the cause.

6. Calibration vs Drastic Reductions

If 4 days is for any reason too long, we should not reduce it by 87% all of a sudden. That is bad science. It is bad testing. It is bad practice. Finding the right time should be done in small steps, not in a single cliff cut. Reduce gradually and measure real effects: staking churn, the link between drawdowns and unstake volume, how quickly people restake aftershocks, and what share of exits actually leave the chain. A cliff cut skips learning and gives us no usable signal.

7. Suggestion: Increase Unstaking Time to 42 cycles (i.e. exactly 7 days; 1 week)

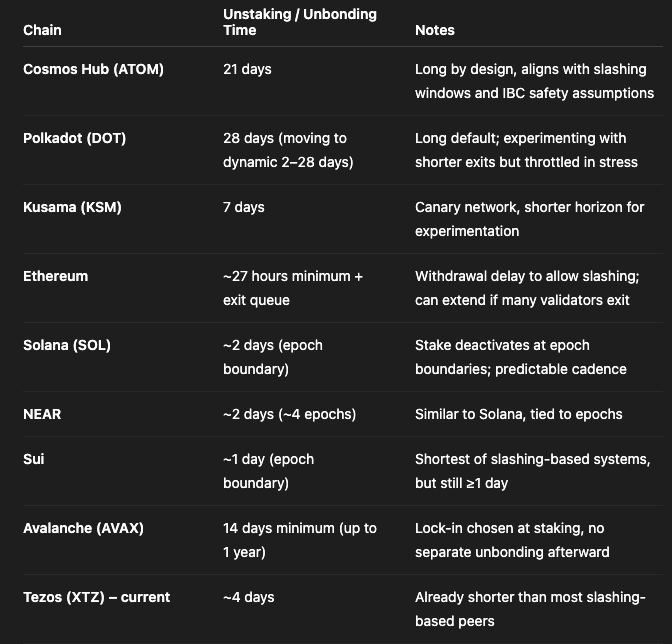

By the same logic, I would go so far as to suggest that we increase unstaking time. Looking at the comparison chart across bonded-stake blockchains, the lesson is clear: among networks that actually secure consensus through bonded staking, multi-day unstake windows are the norm. Tezos should not compete to be the fastest exit. If anything, we should lean slightly longer.

A 7 day window, or 42 cycles under a 4 hour cycle length, is a healthier balance. It places Tezos in line with the norms of other serious bonded proof-of-stake networks, rather than leaving it exposed as the outlier that drains first. A weekly window also gives participants the time they need for news to resolve, prices to mean revert, and emotions to cool before taking action. This is the buffer that breaks the reflex to liquidate whatever is nearest to liquid.

It also benefits bakers. Staking inflows and outflows become smoother and more predictable on a weekly rhythm, which strengthens the operator base and makes rewards steadier. At the same time, 7 days is not excessive: it is long enough to matter, but short enough to fit normal portfolio management cycles.

Rights, payouts, and inactivity pruning can still be accelerated independently. Those should be decoupled from the exit window. The unstake period should remain deliberately long, with 7 days as the more resilient and more natural setting.

The Tezos staking economy gains strength from commitment, not convenience. We should extend that strength, and project confidence, not hollow it out to simply to possibly appease the exact opposite of the market cohort that we should be targeting.