While reducing the inflation rate was one of the original goals of AI and this aligns with that, this design seems to be skewed in favor of the lower issuance rates at the risk of losing the incentive to stake.

The issuance rate evens off dramatically between 30-50%. If 30% of the network is staked then the maximum will be only 2%, and the actual adaptive issuance presumably often lower than that.

If 50% staked is still the target, I struggle to imagine bakers/stakers choosing to lock funds and stake for such a small difference in rewards, when we’re already having trouble getting people to stake when they are earning 15% on a 10% max. In line with this, I also agree that we could increase the ratio that stakers receive vs. delegators to help disincentivize delegation.

If the goal is simply to reduce inflation then this is ok, but if we really do want 50% of the network staked, i see little incentive here to continue staking until 50% vs. staying liquid if the rewards are negligible.

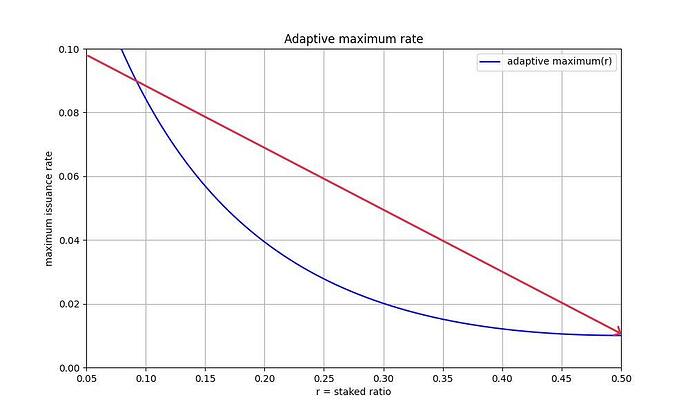

Maybe the curve could be more straight like this (red):