This is a joint post by Nomadic Labs, Trili.tech and Functori

The Quebec protocol upgrade proposal is almost ready! But before announcing the proposal, we want to reach out to bakers to gather their feedback on one particular change in the Adaptive Issuance mechanism: the introduction of a new adaptive maximum.

In a nutshell, this new bound makes maximum issuance dependent on the staked ratio. It prevents potential future scenarios where a stagnation of global staked tez close to the target ratio could lead to undesirably high issuance rates.

In order to smooth out the governance process and the potential adoption of Quebec, we want to make sure that the current implementation of the proposed new feature has sufficient consensus within the Tezos community. Hence, this post provides both a higher-level description of adaptive maximum and an opportunity to experiment with the chosen definition.

Adaptive maximum in the Quebec proposal

Issuance rates on Tezos mainnet are currently bounded by progressive maximum and minimum rates. They determine the acceptable limits for the issuance rate as a function of the time elapsed since the activation of Adaptive Issuance – i.e. from cycle 748. From the start of cycle 808, not expected before December 8th, the progressive maximum bound will remain constant with a value of 10%. This could lead to scenarios where issuance rate can grow undesirably high, even when the staked ratio is close to the 50% target.

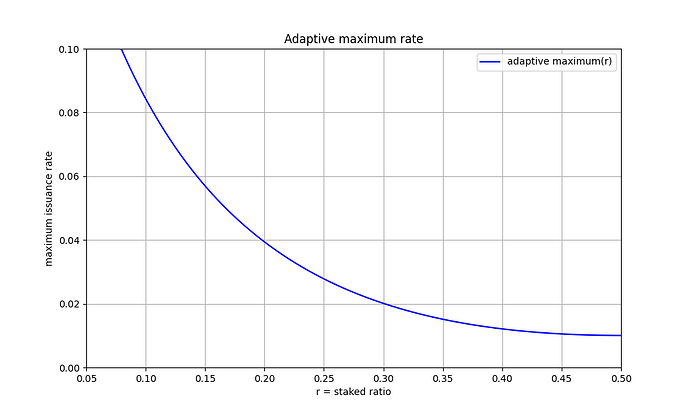

The Quebec proposal addresses this issue by incorporating a complementary adaptive maximum that decreases smoothly when the distance to the target staked ratio decreases. As shown on the plot below, the closer we are to the target staked ratio, the lower the adaptive maximum bound is:

Please refer to Quebec’s documentation for further technical detail, including the specification for the chosen curve and its interaction with the final adaptive issuance rate. The following table illustrates selected data points.

| Staked ratio | 5% | 10% | 20% | 30% | 40% | 50% |

|---|---|---|---|---|---|---|

| Adaptive maximum issuance (approx.) | 10% | 8.4% | 3.9% | 2% | 1.2% | 1% |

Regardless of the value of the new adaptive maximum bound, the final issuance rate will never be below the progressive minimum rate. This prevents issuance from dropping to undesirably low rates.

We refer readers to the Quebec proposal’s documentation for further technical detail on this feature, including the specification of the chosen curve and its interaction with the final adaptive issuance rate.

Call for action

As we mentioned above, we would like Tezos bakers and the community at large to provide their input and feedback on the proposed definition of the adaptive maximum curve, before we announce that Quebec is ready.

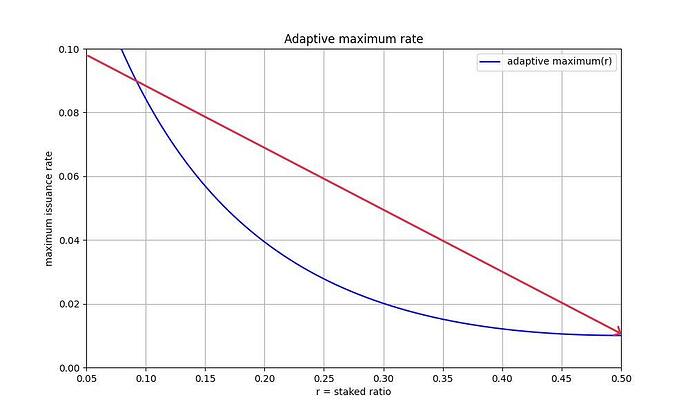

The following notebook can be used to experiment with the definition of the adaptive maximum, and plot the resulting curve.

We invite all interested community members to provide their feedback in this thread, including proposals for alternative definitions. We will assess this feedback before formally releasing the Quebec protocol proposal.

Thank you in advance!