Thank you all for your contributions to this discussion.

Based on your feedback in this thread and other discussions on social media and other community channels, we have decided to revise our plans for the Quebec proposal.

Next week, once a new governance period starts, we will release two variants of the Quebec protocol proposal:

-

The Quebec A proposal will feature, notably,:

-

The Quebec B proposal will include all features of Quebec A and reduce the relative weight of delegated funds in the computation of baking power to one third of their nominal value (this relative weight is currently set to one half).

Reflecting on the discussion so far, most concerns focused on whether the inclusion of the adaptive maximum bound is needed (and why to include it now in the Quebec proposal) and on whether the proposed curve would reduce staking incentives too aggressively.

As for the first concern, we believe that it is best to proactively future-proof the incentives mechanism in order to avoid excessive issuance than to reactively make corrections after the fact. The proposed adaptive maximum bound would improve the predictability of the final issuance rate, tying it closer to the static rate and the target staked ratio. Moreover, should either Quebec proposal be accepted by a majority of bakers in the next governance cycle, it would activate on mainnet before the progressive bounds transition to their final stage. In the meantime, we can continue advancing new and ongoing complementary efforts to improve tooling, documentation, communication and marketing of the (still new) Adaptive Issuance and Staking mechanism, so as to boost its adoption.

As for the concerns on the impact on the curve on incentives, we acknowledge the observations in the thread, and the Quebec proposals include a revised definition of the curve to address them. We develop on this and other topics below.

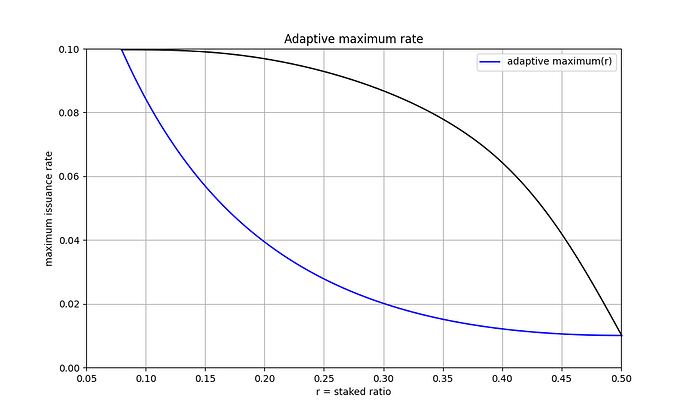

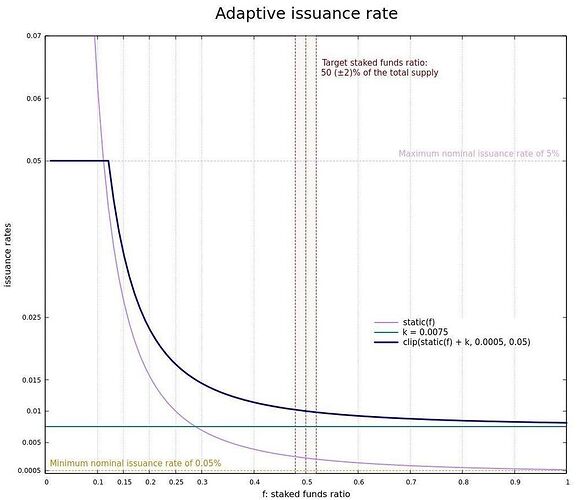

Adjusting the adaptive maximum curve

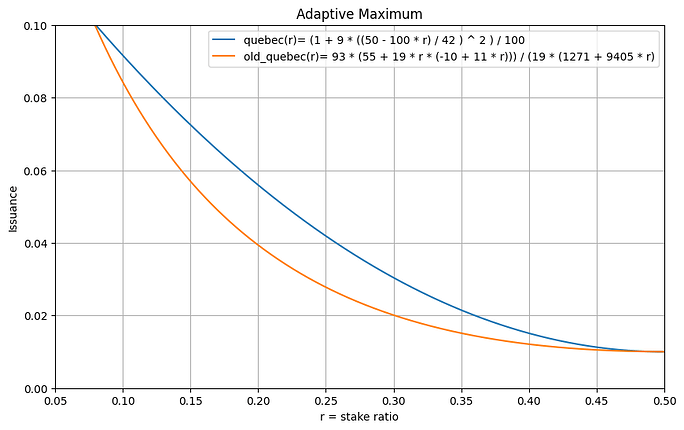

The discussion above brought concerns that the proposed curve reduced incentives too aggressively and that, as a result, the incentives when the staked ratio is over 30% might not be appealing enough to nudge the staked ratio to its 50% target.

We have adjusted the definition of the adaptive maximum curve in the Quebec proposal to address this concern without sacrificing its original purpose: providing a tighter maximal bound which follows closely the static rate component and avoids excessive issuance.

The revised definition implemented in both Quebec A and B proposals is:

adaptive maximum(r) = (1 + 9 * ((50 - 100 * r) / 42 ) ^ 2 ) / 100

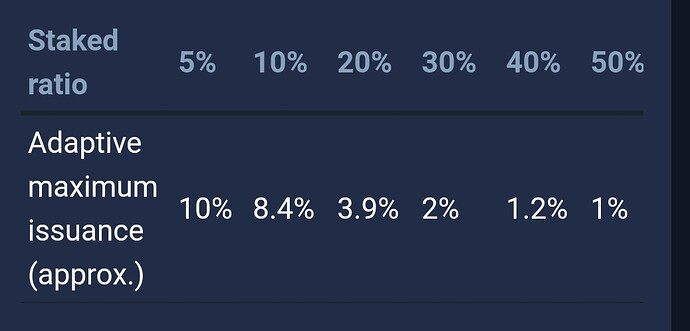

This definition results in higher maximal issuance than the original curve:

| Staked ratio |

Adaptive maximum in OP |

Adaptive maximum in Quebec A / B |

| 40% |

1.2% |

1.5% |

| 20% |

3.9% |

5.6% |

| 10% |

6.4% |

9.2% |

| 5% |

10% |

10% |

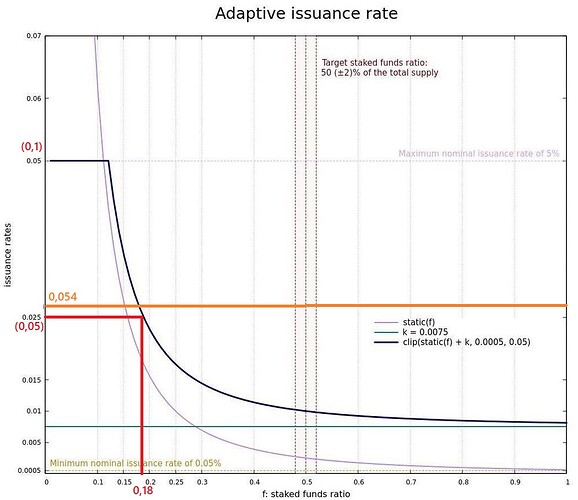

The change in incentives becomes more evident by plotting both candidates together (you will find the sources for these plots and updated definitions in this collab notebook). Notably, we observe that maximum issuance is kept over 2% until the staked ratio is above 35%.

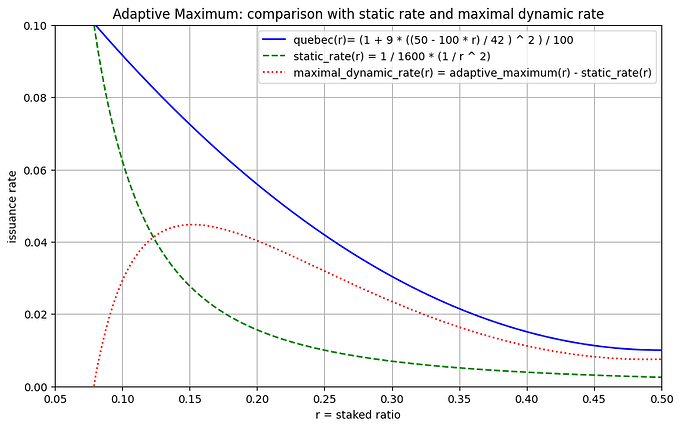

In the discussion above, @tokyo_on_rails suggested a decreasing linear curve and @BakeTzForMe a 180 degree rotation of the original curve alternatives. We believe that the new proposed curve implements a better bound in both cases, as the alternatives would fail to bound the dynamic rate tightly with the static rate and therefore allow for excessive maximal issuance. This can be observed by plotting the maximal value for the dynamic rate together with the static rate and the adaptive maximum:

Reducing the weight of delegated funds in QuebecB.

The Quebec B variant proposes to reduce the weight of delegated funds towards the computation of baking power from currently a half to a third of their nominal value in tez.

This change (and similar variations) has been advocated in this thread as an incentive for delegators to become stakers, but also as a nudge for (public) bakers to embrace staking and attract external stakers more aggressively.

However, the change would impact all bakers by reducing their baking power and consequently their consensus rights – as pointed out, for example by @BakeTzForMe. Indeed the change in the baking power formula would reduce the maximal baking power that 1 tez of a baker’s own stake can attract from stakers and delegators before over-staking and over-delegation come into play from 10.5 to 9.

As a result, we have decided to include this change in a separate proposal, to allow bakers to ultimately decide if this change is supported by a supermajority of bakers.

Note that this change doesn’t require a reduction of the minimum stake requirements to ensure all currently active bakers retain baking rights, as almost all of them have staked at least 6,000 tez of their own funds – that is, with their main baking key.

Other remarks

To close up, we provide a few remarks on other topics raised in the thread so far:

On increasing the limit_of_staking_over_baking

@cryptEMES and other participants suggested allowing bakers to increase their limit_of_staking_over_baking parameter beyond the global limit of 5 – that is, to allow external stakes beyond 5 times the baker’s stake. The rationale is to allow bakers who have already adopted the new mechanism to capture more external stake.

This rather simple change would have deep implications for network security and decentralization:

-

The global limit of staking over baking is intertwined with slashing penalties, and both mechanisms need to be adjusted together so that a baker cannot exploit the slashing mechanism at the expense of their own stakers. This could happen, for instance, if a baker deliberately double-signs a block to immediately denounce themselves, potentially making a profit from the unshared denunciation reward as the slashing penalties are shared proportionally with their stakers. The current values for the global staking over baking limit and the constants governing double-signing penalties guarantee that such attacks are never profitable.

-

Allowing for higher ratios risks effectively damaging network decentralization, as it can lead to concentrating a significant share of the global stake on the operations of a few large bakers.

Thus, we have decided to explore an adjustment of this change for future proposals, allowing for sufficient time for researching and thoroughly testing the implications of this change.

Marketing, communication and education around the new Staking mechanism

@KevinMehrabi (and other community members) have suggested focusing on marketing, communication and documentation to increase the adoption of the new Staking mechanism, rather than on pure technical answers to increase the staked ratio.

While we agree that educating and raising awareness about the new Staking mechanism is crucial – and we indeed initiated several communication, marketing, and documentation efforts in this regard – , we believe these initiatives should complement, not replace, the continuous evolution of the Tezos protocol.

We want to thank all community members who have actively contributed to these efforts across social media, Discord, Telegram and other similar channels.