Sirius LB Improvement Proposal: Direct Incentives for Bakers

(Note: I’ll be using the terms Sirius, Liquidity Baking, and LB interchangeably throughout this proposal.)

Objective

To refine the Liquidity Baking (LB) mechanism by introducing a more inclusive incentive structure. This proposal seeks to:

-

Provide bakers with a direct financial benefit tied to LB activity to align their interests with its success.

-

Increase transaction volume in LB markets, enabling transaction fees to generate sufficient revenue to more effectively offset the subsidy.

-

Elevate LB as a Liquidity Cornerstone of the Ecosystem:

Enhance LB’s intra-ecosystem synergies and composability to unlock its full potential and position it as a valued and indispensable liquidity mechanism within Tezos.

Current Model

Let's refresh the basics, because the purpose of Sirius (formerly, and still commonly, known as Liquidity Baking) is often misunderstood. LB was introduced to enhance XTZ’s status as a store of value by providing deep, on-chain liquidity through a highly correlated pairing between XTZ and tzBTC. This pairing (Tez paired with Bitcoin) ensures that liquidity provision directly supports XTZ’s market dynamics while benefiting from BTC’s stability, and market size within the cryptoverse (and beyond). A robust LB not only strengthens XTZ’s positioning as a reliable store of value but also lays the foundation for broader liquidity applications within the Tezos ecosystem.

Liquidity Baking incentivizes liquidity provision between XTZ and tzBTC by minting approximately 0.833 tez per block, aligning with the protocol’s target rate of 5 tez per minute. That’s 2,628,000 per year or an added inflation rate (assume 1b tez total supply) 0.26% per year.

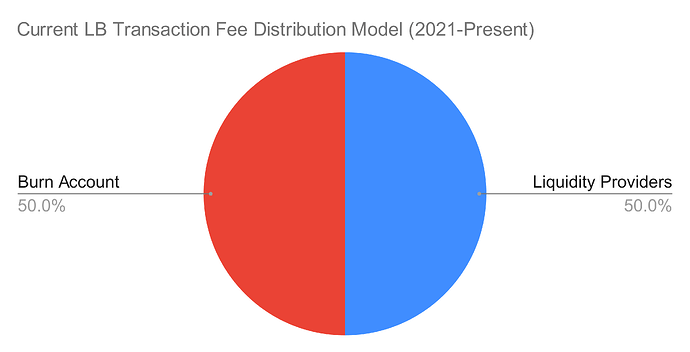

Transaction fees generated by LB activity are currently split as follows:

-

50% to Liquidity Providers (LPs): Rewarding them for providing liquidity.

-

50% to a Burn Mechanism: Intended to offset the subsidy, either in part or in full.

Challenges

However, the current model faces the following challenges:

-

Transaction Fees Insufficient to Offset Subsidy: While the burn mechanism is designed to reduce the impact of the subsidy, current LB transaction volumes have not generated enough fee revenue to make this mechanism effective. This shortfall has contributed to ongoing opposition to LB, as the subsidy is perceived as an unrecoverable cost. However, with higher utilization, the burn mechanism could generate enough revenue to substantially offset the subsidy, addressing a key concern of its critics and reducing opposition among stakeholders.

-

Lack of Direct Incentives for Bakers: Bakers, who are the lifeblood of the Tezos ecosystem, do not receive any direct financial benefit from Liquidity Baking. While LB is intended to provide a long-arc benefit to the entire ecosystem—ultimately strengthening XTZ as a store of value, which effectively benefits bakers—the indirect nature of this benefit is not widely perceived or appreciated universally by bakers. This perception disconnect has led to opposition from some bakers who feel they lack a tangible, immediate reason to support or promote LB.

-

Limited Awareness and Promotion of Liquidity Baking:

Despite being the largest liquidity pool in Tezos, Liquidity Baking has not been fully elevated as a cornerstone of the ecosystem. Its potential impact remains underutilized due to a lack of intra-ecosystem synergies and composability with other DeFi applications and platforms. Strengthening LB’s integration with the broader Tezos ecosystem, while promoting its role in driving liquidity and fostering growth, is essential to unlocking its full potential and positioning it as a prized and indispensable part of Tezos’

Proposed Changes: Transaction Fee Distribution

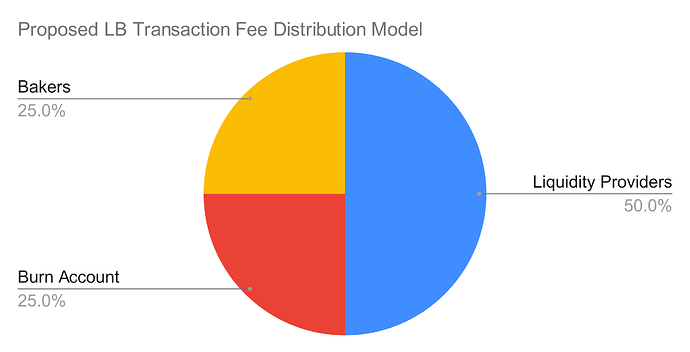

To address the outlined challenges, this proposal suggests adjusting the distribution of transaction fees generated by Liquidity Baking (LB) activity for a six-month trial period. The current distribution allocates 50% of fees to Liquidity Providers (LPs) and 50% to the burn mechanism. The proposed trial distribution redistributes fees as follows:

-

50% to Liquidity Providers (LPs): Preserving strong incentives for LPs to maintain liquidity and keep the pool robust

-

25% to the Burn Mechanism: Continuing to offset the subsidy, with anticipated increases in transaction volume making the burn mechanism more effective

-

25% to Bakers: Introducing a direct financial benefit for bakers tied to LB activity to align their interests and foster active support

How This Change Solves Key Challenges

-

Offsetting the Subsidy:

Despite reducing the burn amount as a proportion, allocating a share of transaction fees to bakers encourages them to not only support LB but actively promote it, which can drive exponentially higher transaction volumes. This increased activity would generate more fee revenue, enhancing the burn mechanism’s ability to offset the subsidy and more effectively addressing the primary concerns of LB critics.

-

Incentivizing Bakers in a Manner that is Perceivable by Bakers:

Bakers will receive a direct financial reward from LB activity (real volume), aligning their incentives with its success. This reduces opposition to LB and positions bakers as active advocates for its adoption and promotion within the Tezos ecosystem.

-

Expanding Awareness and Promotion of Sirius/Liquidity Baking:

By tying baker incentives directly to LB’s transaction activity, it is reasonable to expect that bakers will actively seek to increase its utilization. This alignment of interests transforms bakers into advocates for LB, driving awareness, encouraging participation, and fostering a stronger integration of LB within the broader Tezos ecosystem. This amplified promotion will elevate LB’s role as a vital liquidity mechanism and enhance its visibility across (and beyond) the network.

Trial Period and Implementation

- 6-Month Trial:

- Implement the adjusted distribution model for a 6-month trial period: 50% to LPs, 25% to the Burn Account, 25% to Bakers

- The proposed duration period of this trial is intended to align with the initial trial period of Liquidity Baking itself (from the Granada proposal)

- Monitoring and Metrics:

- Evaluate the impact on transaction volumes, burn mechanism effectiveness, and baker engagement during the trial period.

- Collect feedback from ecosystem stakeholders to assess the effectiveness of the new model.

- Potential Adjustments Post-Trial:

- Based on the trial’s outcomes, the fee distribution can be adjusted, extended, or made permanent with refinements informed by data and community feedback.

Conclusion

The proposed 50-25-25 fee distribution model directly addresses Liquidity Baking’s key challenges by aligning the incentives of Liquidity Providers, bakers, and the broader ecosystem. By introducing direct rewards for bakers, this adjustment ensures their active support, transforming them into advocates for LB and driving increased transaction volume. The resulting growth in activity strengthens the burn mechanism’s ability to offset the subsidy, mitigating a primary concern for the network.

The 6-month trial provides a focused opportunity to evaluate the impact of these changes, using data and community feedback to refine the model for long-term sustainability. With these adjustments, Liquidity Baking can evolve into a cornerstone liquidity mechanism for Tezos, fostering deeper intra-ecosystem synergies and enhancing its role in supporting XTZ as a store of value and driving growth across the network.

I’m excited to get your guys’ feedback, questions, or ideas to help refine this proposal and explore its potential!