Summary

Governance proposal #5 was voted on to raise the stability fee from 2% to 2.5% in order to gauge the market reaction, and gather data, while hopefully driving kUSD at least marginally towards the peg target. At the time of proposal #5 being voted on, we were off peg by ~12%, and with the gov proposal now having been live for about 1.5 days, it’s become clear that we need to make more aggressive changes.

As stewards of the Kolibri protocol, our job is to use all means available to us to get kUSD to be as close to $1 in value as possible. In the long term, market conditions may change as kUSD finds more use cases and markets and it becomes more desirable to hold and use kUSD and easier to arbitrage the price.

However, in the short term, the most powerful levers we have to pull are the debt ceiling and the stability fee. We do not believe additional kUSD is likely to aid the protocol as kUSD is trading below peg (and thus leaving the debt ceiling place creates scarcity for kUSD, pushing us closer to peg).

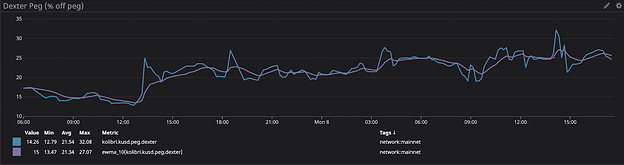

The screenshot below details the past 1.5 days of peg metrics, starting when the stability fee adjustment went live.

Peg volatility between Mar 7, 6:00AM EST to Mar 8, 6:00PM EST (1.5 days)

Holding the debt ceiling constant, it is clear the other lever we have is the stability fee.It’s clear that the previous adjustment was too little to affect the peg in a way that drives it back to target, so we need to continue to increase the stability fee until we see the desired effect.

The metric by which we’ll determine if the peg falls within a “reasonable range” (and therefore stop taking the action voted on below) is when the peg’s EMA10 (so a moving average of the last 10 hours) is within 5% of our target on the high side, with any amount being “below peg” being assessed as “within range” for the purposes of this proposal.

Voting

In order to successfully reach peg and stabilize kUSD, we need to continue adjusting the stability fee upwards with a more aggressive cadence. In order to do that we propose 2 different votes, one to decide on the cadence for adjustments on an ongoing basis until a target point is hit, and the other being how aggressively to adjust the stability fee at each cadence interval.

Vote 1: Stability Fee Adjustment Cadence

- A cadence needs to be selected by which we adjust and reassess the stability of the peg. There is an 8 hour time lock that’s mandatory (and built into the protocol), though we suggest that a minimum of 24 hours (including the 8 hour timelock) is necessary to have all people who use Kolibri a chance to adjust their ovens as they see fit

- Options (all including the 8h timelock): 24h, 36h, or 48h

Vote 2: Stability Fee Adjustment Rate

- A second parameter needs to be determined which is the amount of adjustment done per adjustment event on the cadence selected above.

- Options: +0.5%, +1.0%, +1.5%

As an example, if the winning parameters are 24h and 1.0%, that means that every 24 hours, we’ll be adjusting the fee upwards by 1.0% (so if the fee is currently 2.5%, in 24 hours it’ll be 3.5%). That will continue until such time that the EMA10 (moving average over the previous 10 hours) is 5% or less, at which time the adjustments will cease.

This vote will be open on the public Kolibri Discord, in the #governance-announcements channel for the next 24 hours (on or after March 9 at 23:00 GMT), after which time the winning parameters will be signed by the Hover Labs team and injected into the multi-sig timelock (which has an additional 8 hours before activation), and this pattern will continue on the cadence and adjustment selected in this vote.

Discussions for this will be happening in the #governance-discussions channel, so please come weigh in on the decision there.

- The Hover Labs Team