On Oslo vs. Oxford and Adaptive Issuance

Baking Benjamins

August 16, 2023

Cityscape by water during golden hour. Barcode, Oslo, Norway by Christoffer Engström

What is Adaptive Issuance?

Adaptive Issuance is an intriguing concept from the Tezos blockchain, and this article dives into some of its mechanics and the nuances between the Oslo and Oxford proposals.

To best understand the Adaptive Issuance concept, we highly recommend reading the description from the Tezos core devs:

To summarize very briefly, in the words of the core devs, Adaptive Issuance is:

When does Adaptive Issuance kick in?

Once again, the mandatory reading to start with is the core dev blog:

After the Oslo or Oxford proposal is activated, a separate baker signaling process begins and likely lasts many months or even over a year, to indicate when and if bakers are ready to start the new Adaptive Issuance process.

After many months of signaling and debate, after a steady 80%+ positive support from all explicitly participating bakers, Adaptive Issuance will predictably activate and become the new algorithm based issuing mechanism of the Tezos protocol.

How does Adaptive Issuance work?

Firstly, Adaptive Issuance changes some of the staking concepts in Tezos.

THE OLD WAY…

- Delegate/baker = Person or entity locking up their tez in consensus and signing the work from their baking processes. That’s the address you delegate your tez to.

- Delegator = Person delegating to baker. Tez balance is not locked up.

THE NEW ADAPTIVE ISSUANCE WAY…

- Delegate/baker = Person or entity locking up their tez in consensus and signing the work from their baking processes. That’s the address you delegate your tez to.

- Staker (new role) = Person delegating to baker. Tez balance is locked and “at stake” or “frozen”, along with the baker’s and proportionally liable for any misbehaving by the baker.

- Delegator = Person delegating to baker. Tez balance is not locked up.

Once this Adaptive Issuance (a.k.a. AI) kicks in, the rewards issued are determined by the protocol using a formula that pushes ~50% of the stake to either be a baker, a staker (a.k.a. cobaker, tez balance is locked & responsible for good consensus behavior, but separate from baker’s) or a delegator (funds are liquid). The weight of baker and staker tez is higher than the weight of delegator tez.

The way AI pushes the stake to ~50% is by using a dynamic staking rate in addition to a static staking rate. Both rates increase and decrease appropriately as the stake changes. The area of 48%-52% area is considered to be the “sweet spot” by Adaptive Issuance and there the dynamic rate is frozen with the locked in value as it passes up from 48% or down from 52%.

As we get close to 50% tez staked, the static issuance rate really goes down and the dynamic rate is relied upon to keep the staked tez within the protocol defined “sweet spot”

The dynamic rate adds the sparkles. It stays locked while within the sweet spot but it increases if the stake is under 48% and it increases if lots of stake suddenly leaves the protocol.

For example, in the far future, if 60% is staking and 15% suddenly stops staking, the protocol ups the dynamic staking rate in order to encourage more stake to replace the stake that left. As the stake gets closer to 48%, the dynamic rate growth slows down.

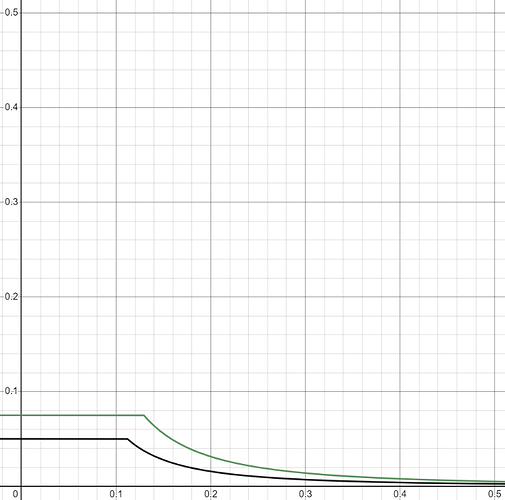

What happens in the beginning when Adaptive Issuance kicks in?

At the very beginning as Adaptive Issuance activates, we can assume ~7% of all tez will be staked because that’s the 7% of currently locked baker funds. In addition to this, we can further reasonably assume another ~15% of the stake will either immediately join in as staker or delegator, accounting for the Tezos Foundation’s stake, spread between 8 different bakers. This would bring us to just around 20% initial stake, on the way to 50%, pushed initially by the static rate and with the dynamic starting to increase up to a combined emissions of 7.5%. The initial emissions of Oslo would be 3% while Oxford would yield 1.5% initially. That’s the starting point from which the rate will be adjusted up, initially, before being adjusted down again as ~48% gets closer.

All current delegators will have to re-delegate to a baker, after Adaptive Issuance is activated, either as a staker or as a delegator.

Bakers will need to explicitly signal on-chain that they want stakers, by changing a setting and allowing up to 5X of the baker’s own stake to “stake along with them” but from tez that’s controlled by the additional stakers’ own wallets. Recall that stakers control their own tez but are liable for any (very uncommon but possible) nefarious actions, either on purpose or by mistake.

We don’t know how exchanges like Coinbase and Binance handle the change over to the Adaptive Issuance model. Exchanges may choose to not lock up their customer delegator wallets and leave them all liquid. They may choose to convert them to staker addresses and take advantage of the higher weight of stakers in terms of rewards.

Exchanges may also give their users a choice of whether they want to lock their tez as stakers or receive less rewards but retain their liquid tez balances as delegators. Recall, stakers lock up their balances along with the bakers’ balance. It takes 5 cycles to add stake and 7 cycles (around 20 days) to unfreeze it, if a staker wants to sell for example.

One thing is for certain, Exchanges won’t miss out on temporary extra APY, so they’ll act fast on the staker vs. delegator question.

Staker / Delegator?

To stake or delegate, that is the question….

We expect others to act quickly as well to re-delegate their tez, in the case of most NFT market users, creators and collectors, they will likely choose to be delegators with fewer rewards but liquid tez, ready to mint with or collect NFTs with.

People who were on the edge of being bakers and perhaps some DeFi users will find their modest but reliable, stable and upward trend returns in being a passive staker alongside their favorite bakers of choice.

The initial new staking activation period is what starts of separate Oslo from Oxford. The first difference is Oslo AI starts emitting at 3% and increases up to 7.5% as explained further below, before sharply decreasing back down and staked tez gets close to 48%.

Where does Oslo come in?

Both Oxford and Oslo proposals are very similar. Oslo is an exact replica of Oxford. The only difference is that Oslo changes Adaptive Issuance in the following 3 ways:

- static curve moved up to double the minimum (i.e. 1% minimum APY from 0.5%)

- maximum issuance increased to 7.5% (from 5%)

- maximum dynamic ratio increased to 7% (from 5%)

Why Oslo?

Oxford indeed offers the lower minimum in theory. Although in practice, under normal circumstances, it is expected that Oslo reaches the target faster and thus stabilizes the dynamic rate lower.

Oslo focuses more on Tezos chain security by responding more fully during low staking periods.

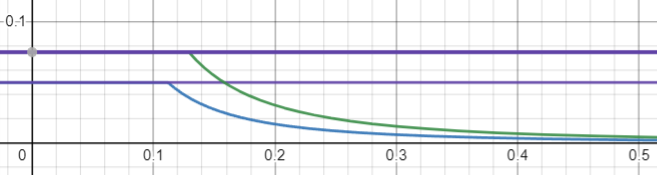

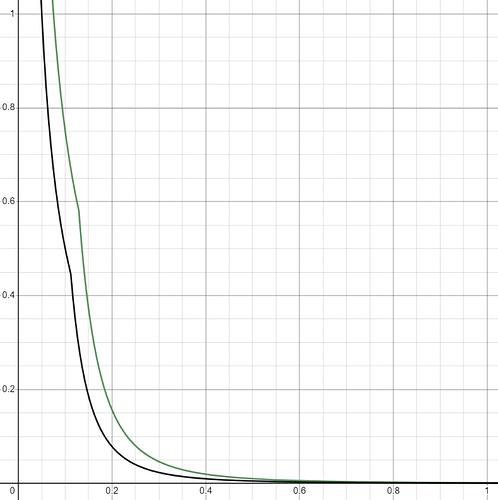

Here’s a possible scenario comparing Oxford and Oslo AI over an undefined time period (x-axis).

Here you can see that:

- Oslo reaches the ideal 48%-52% staking ratio faster initially

- Oslo offsets most of its initial higher emissions by reaching the ideal staking radio sooner and lowering emissions

Oslo is able to respond stronger–with a higher maximum dynamic ratio–in low stake conditions to further encourage participation and secure the chain.

Oslo accomplishes the exact same goals as Oxford of better composability, improving tax efficiency and decreasing the opportunity cost of not delegating.

Primarily, Oslo doubles the minimum theoretical issuance to ~1%.

We believe market forces around staking will stabilize (due to lockup nature of delegator & staker tez), we will achieve the ideal staking ratio it will be relatively stable, leading to relatively long periods of minimal issuance.

With Oslo on board, we believe, we will be able to respond to any eventual decreases in stake with “more juice” (higher APY) and get back to the ideal zone, while giving remaining bakers, stakers and delegators a higher temporary yield, and making consensus a more gamified and lucrative field.

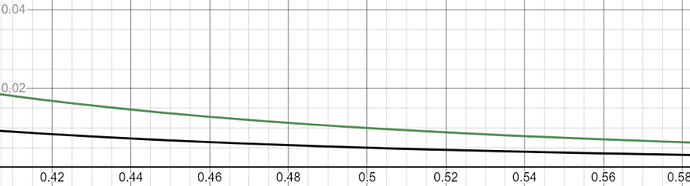

Oslo vs. Oxford Graphs

Activation Scenario Modeling

market rate = market_wide_average_yield: market wide average yield includes both valuation and rewards yield

price trend = long_term_tez_price_trend: how bullish we are – long term price increase per year

buildup = build_up_period: how long to build up stake before launching AI

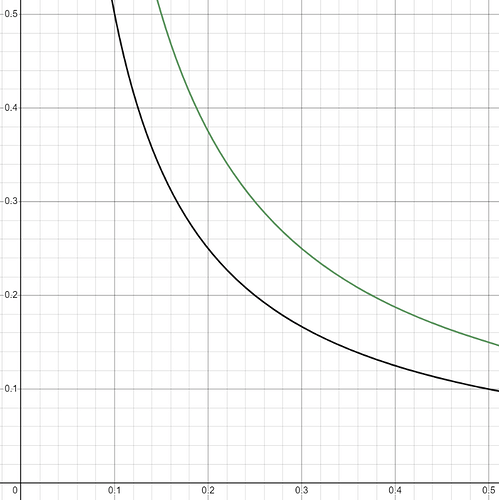

Static Comparison Graphs

Oslo = Green

(theoretical maximum issuance, dynamic in purple)

(maximum APY)

(static emissions)

(static emissions, zoomed into 0.5)

(static only APY)

(static only APY, zoomed into 0.5)

FAQ

Why 1% minimum?

We believe 1% minimal issuance is closer to the competition on the low end and is better able to hold a lasting terminal low APY condition.

Won’t possible emissions as high as 7.5% cause higher inflation than now? (currently ~4.6%)

7.5% issuance at first after AI activation will help drive stake faster to get to a ~50% staking networking. The high issuance will quickly decrease to under the current emissions of 4.6%, settling in and trending lower long term as the dynamic emissions decrease.

The higher initial inflation might attract new participants who lock up their tez in order to maximize their returns with no market risk like in DeFi and NFTs. They will be doing so knowing that inflation will most likely never be be as high for as long anymore and that real inflation will settle in the sub 3% region or lower, if stake is really stable within the ~48-52% staking range.

I’m a low emissions maximalist. Isn’t Oxford better for me?

Oslo helps you most of all because stake conditions will more likely stabilize around 1% issuance than at 0.5% issuance (at 48%-52% stake level).

We want a secure (most important), stable, low and predictable APY which trends down leading to a commensurate and opposite rise in tez token valuation and that’s what Oslo effectively accomplishes.

Oslo rewards existing delegates, stakers and delegators first with a higher yield when there is stake volatility, resulting to more affinity to get involved in the consensus staking process long term, especially as delegates and stakers.

While Oslo offers 2x the minimum rewards of Oxford, Oslo should be better able to settle on a lower dynamic issuance. When it comes to Oslo static issuance of 52%+ stake, it decreases further from 1%, down to even lower. For example Oslo yields around 0.5% static APY at 60% stake level.

7.5% issuance is simply to give more muscle to the temporary market forces of stake change.

Make sure to cast your vote for Oslo today!

TzKT:

Protocol hash: ProsLoUXggfdnzDcqhXZLs6efD3pLYjhjnbZ9d62UB9ToYSKVbW

Source code: