Proposed by Tez Capital (TzC).

What is the Q3NA proposal?

The Q3NA proposal is a 3rd generation (after Qena and Qena42) proposal, intended to accomplish the same common Adaptive Issuance economic goals as stated in the QuebecB and Quebec proposals, using a slightly different approach. From a tech perspective, Q3NA is simply Quebec with 5 line changes in the code and 6 lines of comments.

Please note that if something is not explicitly mentioned below, it remains the same as described here.

Q3NA Proposal Summary

- Same security ambitions as Quebec, with a 50% staked tez security target (note: this is mentioned explicitly to contrast with our old Qena42 proposal, which had a 42% target)

- Lowered maximum emissions bound (a.k.a. curve) (similar to Quebec), in case staked % is stuck near the target

- Reinforced security at 33% staked via the same (modified) maximum emissions bound as above

- Lower (adaptive) issuance by 5 XTZ/min static from turning off the Liquidity Baking (LB) xtz/btc subsidy (i.e., LB is turned off after the activation of the Q3NA protocol)

What makes Q3NA a better choice than your last proposals?

As previously mentioned, we originally injected the Qena proposal to go along with the Quebec A and Quebec B proposals during proposal period #131. Qena was voted though, yet it failed to reach the exploration period threshold of 80% yes votes, missing by just a few percent.

We later injected the Qena42 proposal to go with with the Quebec (i.e., QuebecB with a staking-over-baking-limit increase from 5X to 9X) proposal during proposal period #133. Qena42 was voted through but it failed to reach 80% yes votes due to a core developer bug advisory.

We published a post which explained the reasons for diverting from the QuebecB and the Quebec methodology, specifically with regard to the new maximum issuance bound, as well as the security target with Qena42.

As proposal period #135 opens now, we propose the Q3NA protocol, which is intended to meet the same economic and chain security objectives as the Quebec proposal using the same tool, namely — the max issuance bound, as well as an additional tool — LB subsidy removal.

Q3NA proposal hash: PsQ3NAxQC3pXSizDrKEkPHsarkKD78T58X9CXBfYaiXAi2rsvsD

Q3NA source code: Q3NA · tez-capital/tezos@eda23f7 · GitHub

Will Q3NA need a UAPO to activate if passed?

What is a UAPO?

User Activated Protocol Override: This has been used in the past to address implementation bugs. It would require bakers to install a client that overrides the protocol time of activation. (source: Bug discovered in Qena42: Our recommendations)

We kept our changes minimal and tested thoroughly. The Q3NA protocol was tested locally with the pipeline from the official Tezos repository. Additionally, its activation was tested in a sandbox to test the removal of LB, which isn’t currently directly tested by the Tezos repository pipeline. The Q3NA source code will be submitted for review and we hope the core repository CI will be run on Monday.

What are the objectives of Quebec?

To best understand the objectives of Quebec A/B and Quebec is to read the original blog posted by Nomadic Labs.

An adaptive maximum issuance bound: This new component of the Adaptive Issuance mechanism makes maximum issuance bounds dependent on the staked ratio. It prevents potential future scenarios where a stagnation of global staked tez close to the target ratio could lead to undesirably high issuance rates.

Here’s more information from the Tezos Gitlab documentation:

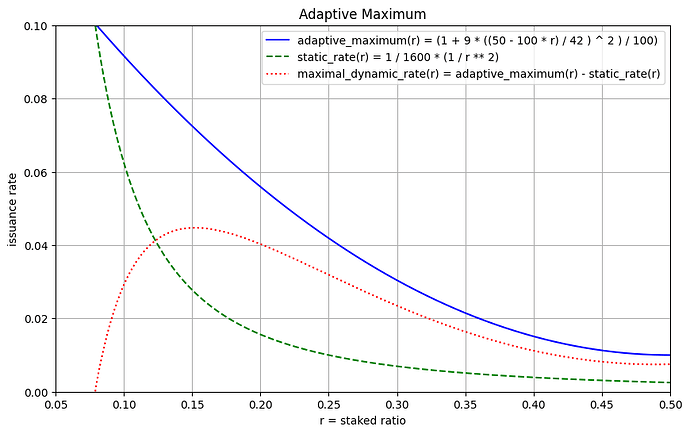

Thanks to the adaptive maximum, the total issuance rate (static rate + dynamic rate) cannot be too far above the static rate (green dashed curve). More precisely, the total issuance rate is forced to stay between the static rate (green) and the adaptive maximum (blue). In other words, the dynamic rate is effectively bounded to stay below the red dotted curve, which plots the adaptive maximum minus the static rate.

Adaptive maximum compared to the static rate, in the range from 5% to 50% staked ratio. (source: https://tezos.gitlab.io/quebec/adaptive_issuance.html#adaptive-maximum-quebec)

Briefly, the goals of the Adaptive Issuance Maximum Bound are to lower total issuance while continuing to sufficiently incentivize the network to reach the 50% staking target.

How does QENA better meet the objectives of Quebec?

(1) Max Issuance Bound

The Q3NA maximum issuance bound offers a more balanced approach to token issuance compared to Quebec. By adjusting the maximum emissions bound, Q3NA ensures sufficient rewards for validators, thereby maintaining network security, while simultaneously reducing overall issuance to mitigate inflationary pressures. This balance better aligns validator incentives with the network’s long-term health and sustainability, effectively addressing the limitations observed in the Quebec curve.

Max Issuance: Q3NA vs. Quebec+LB vs. Paris+LB

Are bakers selling their XTZ?

As part of Adaptive Issuance activation launch of the Paris protocol, the overall Tezos issuance rate went as high as almost 8% (7.5% if adjusted for LB). The issuance rate is currently at ~6.7% (6.2% if adjusted for LB).

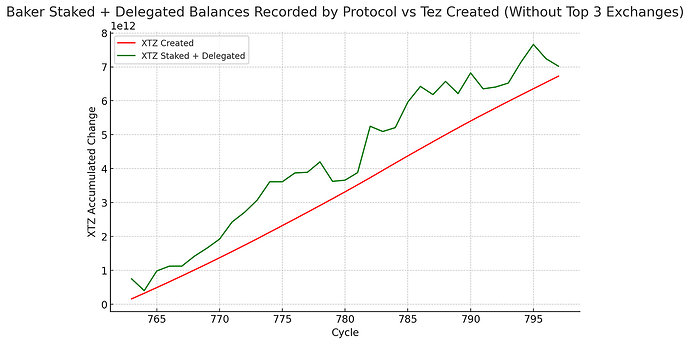

The graph below show what happens to XTZ paid to all bakers, excluding their stakers and delegators. When taken as a whole, non-Exchange bakers mainly accumulate rewards paid to them.

XTZ accumulation: Without Top 3 Exchanges

(2) Removal of Liquidity Baking (LB)

We have disabled the production of tez rewards which are put into LB at a constant rate of 5 XTZ/min.

What is Liquidity Baking again?

Liquidity baking incentivizes large amounts of decentralized liquidity provision between tez and tzBTC by minting a small amount of tez every block and depositing it inside of a constant product market making smart-contract. (source: Liquidity Baking — Octez & Protocol products documentation)

Most people take advantage of LB by purchasing the SIRS token as described here: https://tezos.gitlab.io/active/liquidity_baking.html

Has LB attracted a lot of liquidity?

In the past 24 hours LB has produced a volume of $193K (USD) and the total value locked (TVL) is $8.6M. The current APR is a 21.34%.

How much does LB cost Tezos?

LB produces an extra 7.2K XTZ per day, 216K XTZ per month and just over 2.6M XTZ per year.

What are some of the negative impacts of LB?

The fact is that what LB does, in effect is sell 2.6M XTZ per year for the price of 0 (tz)BTC. The results of such a move are liquidity accrual for LB and the price depreciation for XTZ/BTC as short sellers find it a convenient vehicle to bet on the long trend of XTZ losing ground against BTC.

LB is a very clever way to generate decentralized liquidity but unfortunately the current conditions of decreasing XTZ/BTC value do not favor it. Just like extra issuance caused by the Adaptive Issuance emissions without a maximum issuance bound, LB acts as a way to increase the sell pressure Tezos is burdened with.

Most people currently just farm LB inflation at the cost of XTZ sell pressure with no economic velocity of note to produce enough positive economic effects, at this time.

The DeFi instruments which currently utilize LB, like Kord and Youves should be OK (temporarily?) with the ceasing of the LB subsidy. We will be able to observe the resultant economic effects and adjust going forward with more data at our fingertips

What about the burn mechanism built into LB?

Given the current economic activity that’s produced by LB, the burn mechanism can be said to be “a drop in the bucket.” We need to see a velocity increase of 50X-100X to appreciate the efficacy of the burn inflation compensatory mechanism.

What should happen with LB?

We believe it’s most prudent to turn LB off now and propose it again at a later time when the XTZ/BTC trend has started to go up for at least 3 months, ideally even longer to build more buyer side resilience. We hope that when proposed again, the toggle vote threshold needed to turn off LB will be lowered to properly capture the stake which is eligible to turn it off.

Why don’t you use the native LB toggle vote?

The toggle vote is explained here: Liquidity Baking — Octez & Protocol products documentation

Having the equivalent of 111 BTC of liquidity is nothing to scoff at but, as things stand it’s simply not worth the price Tezos is collectively paying.

The entities, including bakers, that are utilizing LB and benefiting from the subsidy are unlikely to give it up for nothing. LB is a reliable way to extract value from Tezos without a proven benefit, at this time. The 5 XTZ/min inflation pressure on Tezos issuance is static, so it will eventually become 25% of overall issuance, then 50% and so on. That simply doesn’t make sense given the Adaptive Issuance we purport to use.

We have a unique opportunity to balance overall issuance. Everyone sacrifices something for well being of Tezos.

Turning LB off at this time also opens up the opportunity for better ideas to be implemented in the future, which accomplish the same goal of fostering DeFi, at a lower cost to Tezos as a whole.

Now is a good time to discuss TezosX and how we want to foster DeFi in our shared L2 hyper-performant blockchain future! Let’s figure out how to utilize our resources better. Perhaps we can design a better LB to support other projects, including Etherlink, USDtz, etc.

If we don’t disable LB now and reassess the situation, we may never get another chance to do so.

Summary

Q3NA is a third-generation protocol proposal for Tezos, following Qena and Qena42, that aims to improve the blockchain’s economic goals and security. The key aspects of the proposal are:

Core Features

- Maintains a 50% staked tez security target

- Implements a lowered maximum emissions bound (similar to Quebec)

- Reinforces security at 33% staked through modified maximum emissions

- Reduces adaptive issuance by 0.5% (5 XTZ/min) by setting subsidy to 0 for Liquidity Baking (LB)

Key Improvements

- Offers a more balanced approach to token issuance compared to Quebec

- Better aligns validator incentives with network health

- Addresses limitations in the Quebec curve

- Removes the Liquidity Baking subsidy, which currently costs about 2.6M XTZ annually

Liquidity Baking (LB) Changes

- Proposes turning off LB due to current market conditions

- Suggests reintroducing LB later when XTZ/BTC trends improve

- Recommends lowering future LB toggle vote thresholds to better capture eligible stake

- Addresses concerns about the current LB system’s impact on XTZ price depreciation

The Q3NA protocol proposal offers Tezos a unique opportunity to enhance network security, promote economic sustainability, and lower overall issuance — empowering a balanced, future-proof ecosystem. By embracing Q3NA’s carefully designed emissions model, we can prioritize long-term network health and value for every participant, from bakers to token holders.

Join us in supporting Q3NA as a proposal rooted in community values and designed for sustainable growth. Cast your vote to make Tezos stronger and more resilient. Let’s build a better network together — vote Q3NA!

Tezos ![]() from Tez Capital (TzC)

from Tez Capital (TzC)