Funny you talk about lower friction. I’m still holding 1k usdtz that I cannot swap back to USDC since last year…

There’s no reason for that. You can swap USDtz to USDC on tezex.io or you can go through a mintery at any time. People do it every day.

Feel free to ask me any questions or seek my help at any time.

I definitely respect the initiative of community members who are not full-time core developers injecting their own protocol proposals.

I’m not sure everyone realizes the amount of extra work it creates and stress it puts on our development process to prepare multiple proposals in the same period with permutations of a feature set. This is why we request comment on new features as early as possible in their development by writing and sharing TZIPs.

It’s clear from discussion around the Granada proposal that some aspects of the liquidity baking TZIP were overlooked so I’m happy bakers now have a choice on whether to switch it to an asset other than tzBTC. This is the right way to handle this situation and regardless of the outcome I think the Tezos community will be stronger for it.

Thank you!

If we were to switch to a USD stable coin my preference would be for USDC.

#1 - Blockchain.com is not going to give me 13.5% interest in USDtz as they do with USDC. For people new to crypto blockchain.com ( used to be .info ) was the first chain explorer and is a well tried and true business in the space.

#2 USDC dwarfs any competition mentioned here. It is far more accepted with far more liquidity in more places.

#3 USDC has many, many more interested parties, with far greater resources in the industry watching and evaluating it for fidelity.

Thanks Sophia, would you please give some review comments from core developers point of view to this new proposal ?

It would be interesting to hear how much work downstream for how many people a change like this might mean.

As a non-dev it seems like a simple change (code wise), but I obviously have no idea.

Are you aware that

- there is no native USDC on the Tezos blockchain.

- blockchain.com does not support Tezos native tokens

- you can’t provide liquidity on Tezos and at the same time earn interest on bc.com

- the APY for liquidity baking is currently 100% which outshines bc.com’s offer by multiples

- USDtz is backed by 100% USDC on Ethereum, and can be swapped/claimed

While I don’t mind to prolong the tzBTC experiment for another 3 month, I would definitely like to see more liquidity and volume on the USDtz pair and would welcome USDtz liquidity baking for this or the next protocol amendment.

@KevinMehrabi are there plans underway to get USDtz listed on a CEX? maybe that helps with pitching the idea to the masses.

@JarrodWoodard need to be careful here - USDC has simply announced, very much so how OpenSea had announced. and then they [allegedly] deprioritized tez for MATIC. i reckon i’m better off with a bird in hand now than two in the bush later. worst case, USDC does launch at the same time USDtz is liquidity baking, but that’s ok… may lead to some fragmentation, but the alternative, IMO, is way better in that we may actually get a way to clear big trades pegged to a stablecoin. best case USDC doesn’t launch for a year, but (assuming USDtz becomes part of LB) tez won’t be dependent on Circle to continue its progress. somewhere in the middle case USDtz struggles with adoption in LB, USDC doesn’t launch, but the community (to @sophia’s point) will have experienced/experimented something new on its own.

Does not make any sense in context of liquidity baking. For LP it’s best to have pairs that correlate a lot. We all want to have XTZ gain value against USD ultimately (no correlation). But each time XTZ would gain value, LP would lose XTZ to USD (impermanent loss). BTC and Tezos correlate more than XTZ and USD, therefore it makes way more sense to provide liquidity to a BTC<->XTZ pool than to a USD<->XTZ pool (from a liquidity provider perspective).

I can’t speak to the choice of asset, but I’ve looked at the changes to the code and they appear sound.

David, that’s not the purpose of Liquidity Baking, and also that’s not what impermanent loss is, nor is impermanent loss really a concern here.

LB is not meant to be another yield farming option akin to other DeFi options you have out there. It’s meant to power and expand Tezos DeFi to multiples beyond its own value. LB as a XTZ-USD pair provides a lower risk profile than a highly correlative pair. That’s the point. You’re probably not the liquidity provider market for LB. It’s a lot easier to fill up a TVL based on a lower risk profile than a higher risk profile; for people to hedge between XTZ and USD 50/50. This is for people who are concerned about market volatility and so they don’t want to be fully in crypto nor fully in USD, they want to go half and half and make their money off of the trading volume between the two (of which XTZ-USD is about 5x more than XTZ-BTC in centralized exchanges), which will matter whenever the subsidy is removed and fees are no longer burned. Until then that volume still means a lot with regard to mitigating the inflation of the subsidy since fees are burned.

Further, that is not what impermanent loss means. Impermanent loss is not the sense of loss you feel between two competing investment strategies. What you’re thinking of is opportunity loss.

Impermanent loss has to do with an event that occurs within an individual investment in a Liquidity Pool. That is when the price changes and thus the two piles of inventory you put down are off-balanced, and you have one larger amount of an asset than you put down and one smaller amount of the other asset (I said amount, not value), which happens whenever the price changes from whence you invested. THAT is impermanent loss. Impermanent loss can then be mitigated by the fees that are gained over time, or when the price returns to the point it was when you invested.

Also when you have two highly liquid/convertible pairs in a CPMM, impermanent loss doesn’t matter really because you can convert the larger amount of the asset to the other asset without slippage. This is the case with USDtz. You can convert on TezEx or with a Mintery as explained in the original post. And of course you can convert XTZ in a million other places.

Great, thanks for the help, I will see if I can swap back. Another issue I see with Usdtz is the fact that it’s not available to US residents, which I would assume that’s the reason why there are no US bakers minting Usdtz. So why would one want to swap out tzbtc for something that is not available for the largest market in the world?

So a couple things.

-

Yes we are working hard to expand participation to the US. It takes time and resources, the PsCUK proposal passing would certainly help in that regard.

-

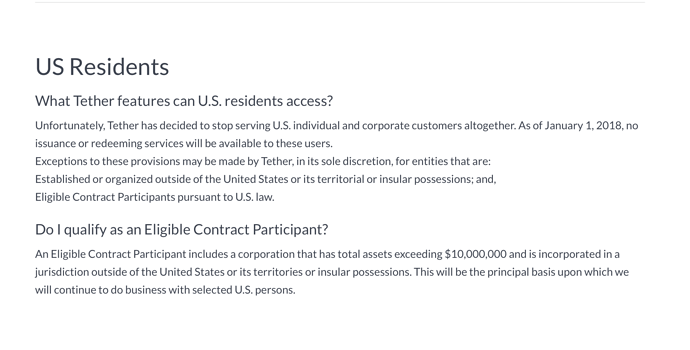

Tether (USDT) has a similar restriction. See: FAQs | Tether

Nonetheless, XTZ/USDT achieves more volume every day than any other pairing of XTZ. That is, not only is XTZ-USD traded 5x more than XTZ-BTC daily (i.e. 5x more volume), and not only does XTZ-USDT alone makes up the majority of XTZ-USD trading, but also XTZ-USDT trading alone far outweighs XTZ-BTC trading daily.

XTZ/USDT achieves more volume every day does not imply XTZ/USDtz achieves more volume every day.

Your statement is not wrong, but you seem to have missed the point. Kevin was responding to the concern about USDtz being restricted to US residents, and how that might negatively impact liquidity baking by excluding a huge part of the market.

Kevin said USDT is also restricted to US residents but even so, XTZ-USDT still has more daily trading volume than XTZ-BTC which is not restricted to US residents. Being restricted to US residents doesn’t stop certain trading pairs from having more daily volume than unrestricted trading pairs.

Personally I prefer kUSD, as it is community owned and already has traction within the ecosystem. In the past I’ve had issues with swapping back and forth between USDC and USDtz

Please see previous comments referring to the role of algocoins and how they are stabilized. Although, kUSD and uUSD would be the most immediate beneficiaries of a scaled USDtz, they themselves wouldn’t work for liquidity baking given how it’s created, the collateral they need to scale, and the increase of stability fees necessary for them to hold their peg. Without convertibility they lose their parity with the USD. A scaled USDtz would enable them to scale and keep their peg without shooting their stability fees through the roof. In fact we’re developing a tool to help on that end systematically which is like curve.fi on Tezos.

This is a redirection and a non-answer. We’re not talking about subsidizing usdt, but we’re talking about usdtz so not sure why it would even matter in this context. Second, the fine print in what you posted allows “eligible participants pursuant to US law”, which compared to your usdtz terms and condition it says any transfer to US citizens is void.

So what guarantees do we have in you, with the admin key that can burn and print at will, that you won’t burn the amounts of usdtz that may or may not be held by US residents?