You are correct. There are many other factors. This however is pointed out merely as a data proxy.

Secondly, take a look at Quipuswap analytics and the history of Tezos liquidity-volume ratio. USDtz has literally outperformed every other coin on Quipuswap. That’s another proxy.

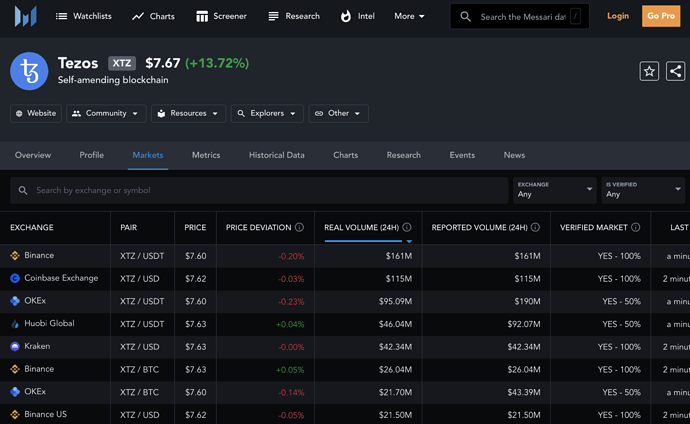

Taking a snapshot of Messari right now, at at time when Tezos is doing very well in terms of overall volume, we can see how individual markets are doing. It’s clear that there is much more trading of XTZ-USD than XTZ-BTC.

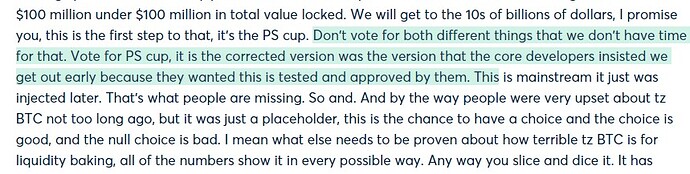

Another way to look at the subsidy of LB and whether we are ‘doing well’ in terms of neutralizing the subsidy (a built in mechanism of LB is that the .1% fees charged by AMM traders are burned to offset the subsidy in part or in full), is to see if LB volume is living up to it.

The subsidy is 2.5 tez per block, which is 7200. At 30 second block-times, there is a ~2,880 total subsidy of XTZ per day. Since the fee (which is burned) is 0.1%, 1000x that daily subsidy would need to be produced as volume per day. 7200*1000= 7,200,000 XTZ volume needed per day average needed to offset the subsidy.

At $7.67 price XTZ, that would be $55,224,000 in volume per day Average that Liquidity Baking AMM would need to achieve in order to completely offset the subsidy.

Looking at the Messari chart again, not a single XTZ-BTC market appears to achieve that in this snapshot. In fact, combining multiple XTZ-BTC markets hasn’t achieved that. However, several XTZ-USD or XTZ-USDT markets have been achieving that individually.

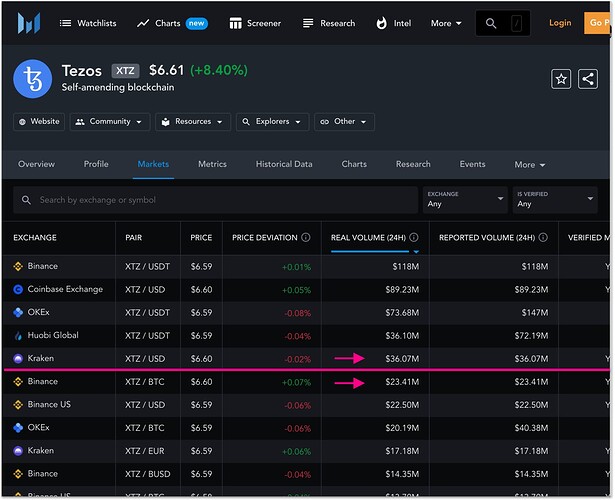

For good measure here’s another such snapshot from yesterday when the price of XTZ was lower. At the price of 6.60 per tez, 6.61*7,200,000 XTZ = the neutralizing volume number to meet or beat would have been $47,592,000

The highlighted line shows (below it) the first XTZ-BTC market making its appearance.